Commodity Boom Looms - How Investors Can Take Advantage Of It

Published on November 10, 2017 @ 8:19am

We can always find value in the equity markets - no matter what the environment is. Fundamentals and technicals are the crux of our ability to identify individual company stocks and sector based ETF's for short and long-term profits. We do it every day, and our subscribers have learned the power of this very important investing methodology.

However, what if we're now entering a very important new economic cycle - one that could potentially be devastating to certain companies and sectors? I'm referring to a reflationary environment, and ultimately several years out, a potential hyperinflationary environment.

No, we're definitely not dooms day pitchers that the sky is falling. If you know us, then you know we've been raging bulls for years now. Those dooms day folks have been screaming the sky is going to fall for years. The result? New astronomical highs for stocks and those individual companies that have taken advantage of cheap money, and have proven earnings are the key to investment returns.

Just look at our track record. It doesn't take a rocket scientist to see we continue to take advantage of the ongoing bull market. But, like history has proven, at some point everyone is going to be right - even the dooms day preachers. It's inevitable, everything is bound to change - especially sector performance.

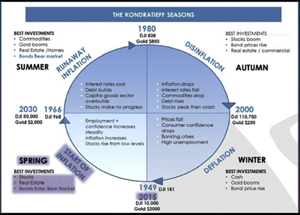

What I'm saying here is if you look at key economic cycles over the last 100 years, everything changes - just like the seasons change. And, if what our research is telling us proves to be true, we're in the very early stages of a developing reflationary environment - one that's going to provide a big lift for commodities - a massive sector that has clearly underperformed the rest of the markets for many years now.

Some of you economic history buffs may or may not be familiar with Nikolai Kondratieff, a Russian economist in the early half of the 1900's. Unusually - and somewhat unpopularly - a proponent of the New Economic Policy in which promoted small private, free market enterprises in the Soviet Union.

Some of you economic history buffs may or may not be familiar with Nikolai Kondratieff, a Russian economist in the early half of the 1900's. Unusually - and somewhat unpopularly - a proponent of the New Economic Policy in which promoted small private, free market enterprises in the Soviet Union.

He was an astute student of the entire world's economies though, throughout history, and believed that Western capitalist economies go through long-term cycles of growth and recession that don't last for years, but for decades. His thought was that these super cycles, now called "Kondratieff waves," can span as much as 60 years.

In short, here's a pie chart of some of these historically proven theories as they relate to economies of cycle over the last several decades, and where we're likely headed over the next several years. As you can see, we're entering the start of a reflationary period, which is typically what follows a deep deflationary cycle - an economic environment we've had for almost a decade now.

It's not as if you can run out and make money right away on this type of extremely long-term fundamental assessment, however, it can give you a glimpse into how things may unfold over the next several years. And more importantly, where and how to start considering investment strategies based on economic cycles.

We're already seeing more popular commodities like gold and oil getting a lift in recent months. You can see the bottoming process developing. It's likely not going to come with further volatility along the way, but opportunities are starting to surface. Look at copper and other basic materials - including those individual company stocks that stand to benefit. The writing is on the wall.

Further, we're clearly seeing a longer-term downtrend developing in the dollar. Just look at this multi-month chart of the US Dollar Index here.

Is this all going to unfold in a matter of a few short months? No, however, if you have a pretty good idea about where things are headed over a long period of time, it's about as good of a crystal ball as you're ever going to get when it comes to investing in stocks.

That's what we do - we keep all of our subscribers abreast of the markets every move, every day. We identify potentially profitable opportunities before they surface, and we email that information to our subscribers every day the markets are open, in addition to timely text alerts when we've got something pressing to communicate to our subscribers.

That's what we do - we keep all of our subscribers abreast of the markets every move, every day. We identify potentially profitable opportunities before they surface, and we email that information to our subscribers every day the markets are open, in addition to timely text alerts when we've got something pressing to communicate to our subscribers.

"We have no allegiance to anyone except our subscribers, that's what makes us different", says lead Viking Crest analyst John Monroe. "We don't have anyone telling us which stocks to pick, when to take profits or where the next bull market is going to be. We know how many Wall Street Firms work, and we're not impressed. That's why we started Viking Crest - we're 100% independent and unbiased working hard every day to help our subscribers make more money in the markets."

As a matter of fact, we're so convinced our service is better than anyone else's out there, we're willing to give every serious investor or trader a FREE 14-Day All Access Pass to our site and service - no credit card required and no obligation whatsoever.

We're fully transparent with every single pick we've put out there - when we picked it, what price we picked it at, when we suggested selling it, and the returns associated with each and every pick.

That's rare these days, but if you try the service - log-in to our site, start getting our daily email newsletters and text alerts - you'll see exactly what we mean, and why we love what we do - helping people make more money in stocks..

Happy Trading!