Knowing Who You Are - The Most Important Path to Profits

Published on December 29, 2017 @ 5:52am

As 2017 comes to a close, we thought we'd take the opportunity today to answer many questions that come across our desks from time-to-time. In an effort to help all of you become better investors or traders - whatever it is your preferred strategy might be - we'd consider today's edition as important as anything you may ever read when it comes to the markets, and investing in stocks.

We'll start with the age old question of what's more profitable, short-term trading or long-term buy and hold investing? It's a question that is not only complex underneath the surface, but one that definitely seems to challenge market participants year in and year out.

As we head into 2018, there's no question the markets have clearly extended themselves beyond what many out there never could have imagined. As a matter of fact, it's one of the most hated rallies in market history. Why? Because many investors have been left sitting on the sidelines for years waiting for the markets to crash, which historically does have somewhat of a habit of happening anywhere from about four to seven years.

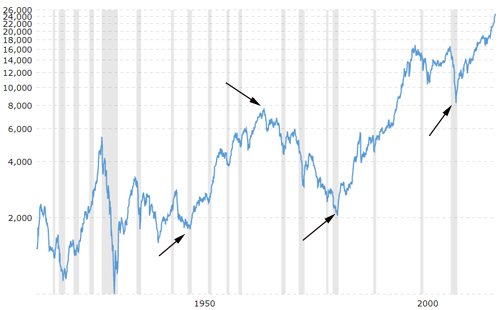

However, it's all about timeframes. We've addressed this before and we'll address it again here today. Provided below is a 100-year historical chart of the DOW, along with a few key pivotal points throughout history. Sure, the markets have had deep major selloffs before, but it's the timeframes in question that become somewhat of a myth.

You can see here, following the crash of 1929, the markets finally bottomed in 1932, and then went on a fairly volatile run that didn't end until early 1966. Then, the markets went into a fairly consistent decline until it bottomed in 1982. Following that bottom, the DOW has rallied ever since - despite all of the market crashes that have taken place over the last 25 years.

So what's the point here? Depending on your age, your preferred timeframes and strategies, there's a very strong argument that buy and hold investing in quality companies does end up garnering the biggest returns when it's all said and done.

There's also a very strong argument that the best time to get aggressive is when the markets have already suffered an extended period of a major correctional mode - like the bottoms of 1987, 2002 and then again in 2009. In other words, when everyone else has thrown in the towel, the sky has fallen, and there appears to be little hope left, that's usually the best time to step in and buy good quality companies to keep for years on end.

So you might be thinking, what about what happened from 1966 to 1982? Well, the good news is when it comes to long-term developing tops, they're usually always pretty identifiable on the monthly charts. Meaning, they're fairly easy to spot within a reasonable timeframe before the markets end up staging their biggest declines - like the top of 2007, which was saw developing later that year.

More importantly, there was a tremendous opportunity to still make money in stocks by shorting names with a lack of quality that had gotten way too overly extended from a valuation and/or growth perspective.

The bottom line is too often investors get caught up in TV shows like "Fast Money", and the short-term minutia that continues to take place in the markets from day-to-day. However, there's still great money to be made on a short-term basis in any name or ETF - you just have to be on the right side of the trade, and more importantly you have to exercise a tremendous amount of discipline - knowing all well your strategy and timeframes are short-term in nature.

Hindsight is always 20/20. Every one of us have experienced that coulda shoulda woulda moment in the markets several times in our life. But, if you adopt a very clear strategy for yourself based on your own very specific financial situation, age and risk tolerance, then you've mastered far more than probably 90% of the market participants out there.

Just make sure whatever your strategy is, you're willing to accept everything that goes along with it - missing out on major homeruns, getting stopped out, holding for way too long, the list goes on and on. But, there's no denying the most important thing to identify is to know who you are as an investor or trader.

This brings us to another age old question that comes up all of the time - which stocks are worth a long-term buy and hold, and which stocks are worth trading on a short-term basis? Do we hold them, do we trade them?

First, we want to re-iterate something we've said on so many occasions over the years - WE ARE NOT A PORTFOLIO MANAGEMENT SERVICE. Your strategy is your strategy, whatever that might be. We're simply a very thorough resource for providing all of our subscribers with ideas we think are well worth your attention on both a short and/or long-term basis, as well as providing you with accurate and reliable market commentary, and what we believe to be tradable index and ETF opportunities from day-to-day.

It's also important to remember our job as a service is to continue to bring you new ideas month in and month out, and to cater to every type of trader and investor out there. We've got clients of all sizes, strategies and risk tolerance.

Therefore, we can't just continue to add stock after stock to our open list without removing stocks along the way. That would become a disaster for anyone out there trying to decide which ideas are still worth considering and which ones are better than others etc., because most investors don't have an unlimited amount of money to participate in every single idea over the course of even just several months.

Further, although many will simply act on the text alerts we send out, we can't emphasize how important it is to read the newsletters for all of the details associated with an idea. Why? Because when we add or remove an idea, we're always going to explain why, the potential the idea might have, and the risk associated with it on both a short and long-term basis.

Additionally, more often than not, when we remove a long-term idea it's because we're making room for a new idea, and we'll always tell you whether or not we still like the company in question on a long-term basis.

The bottom line is you have to use our service in a way that best suits your age, timelines, goals, risk tolerance and strategies. Once you've figured that out, we're certain you'll find our service as valuable as literally anything else out there - at least that's what we've been told by major market players over and over again.

With all of this being said, we do have some very tried and true rules when it comes to how to play and what to do with a specific idea...

If you get sucked into a penny stock, it's usually going to be because your eyes lit up with the idea of fast money. It's our thinking most penny stocks will end up failing and going to nothing. However, there are those few and far between that do end up moving dramatically higher for phenomenal returns. So, it's important you only ever invest in a penny stock what you might be willing to completely lose. Even then, penny stocks are something we'll never suggest to you here.

When it comes to NASDAQ and NYSE listed small and micro cap stocks though, and whether or not you should trade the idea in question or invest in it for the long haul, just ask yourself this question - does this idea have the potential to dramatically change an industry, change lives or change the world?

If the answer to that is a resounding yes, then it's OK to allocate whatever it is your comfortable with and just sit on it forever. If the answer to that question is NO, then it's only worth trading on a short-term basis. It's that simple, because most all smaller stocks are extremely volatile - they go up and they go down, but most will never graduate to large cap status. However, this once again is another big reason it's important to read each newsletter, because we will always tell you our thoughts on the above.

Then, there's the high risk of development stage biotech. This is a category that deserves its own, because although every biotech out there claims it's going to change lives, most won't ever even come close to it. Therefore, it's important to remember the inevitable risk associated with every single development stage biotech out there.

Lastly, it's always going to be our thinking that most long-term investing portfolios out there should be heavily weighted to companies that are already fundamentally proving they know how to grow revenue and earnings, while still offering the idea they will change industry, change lives, and/or change the world. These should be the staples of most everyone's portfolios. And, all you have to do is go through our current open picks on our web site, and our previously suggested picks, to find out which companies we believe fit that bill.

We always try and focus on good quality companies we believe warrant your consideration, along with always providing you with what we see as being good risk/reward short-term index and ETF trading opportunities. As most all of you who have been with us for a long time know, that's our MO - to find quality companies with either great fundamentals, undervalued valuation metrics and/or tremendous growth potential on a long-term basis.

Actions To Consider Today:

Hold TNA or IWM.

Hold GUSH and trail gains with a protective stop - with a near-term target on WTI Crude of $63 and change.

Trail gains in any individual company ideas with protective stops you're comfortable with.

Individual Company Updates:

None

To view current open individual company picks, log-in here: https://www.vikingcrest.com/member. Note: short-term ETF trades are only provided within the daily newsletter.

If you have any questions or would like further details regarding any of the information provided above - or anything else you're thinking about buying or selling out there - please don't hesitate to call your Rep . at 619-369-9316.