Macro Analysis of the Markets' Roller Coaster - Must Read Analysis

Published on February 9, 2018 @ 10:25am

Hello everyone. I'm John Monroe, lead analyst here at Viking Crest. I'm sure many of you are glad it's Friday. It's been a heck of a week for the markets, and although most names out there are pretty much underwater since the markets topped out 10 trading days ago, we do believe most of the damage on a short-term basis has been done.

Does it mean the markets can't go any lower? No. However, based on our internal technical prowess here, we are convinced the NASDAQ Composite won't go much below 6,600 in the near-term, which isn't all that far away considering where the index is now. It's even possible the index won't even find its way to that level before we see some sort of significant bounce again.

Why the possibility of 6,600? To eliminate a lot of the recent noise, I've provided a weekly chart of the NASDAQ Composite here showing you some key retracement levels dating all the way back to the October 2016 bottom to this year's high, as well as last year's mid-July bottom to this year's high.

As you can see, there's a very key confluence area there that should support the markets around current levels, or at the very worst just below 6,600 in the event they decide to move lower over the next several days.

The bottom line is starting next week we're going to be selectively adding those bigger and better quality names to our open list that we've stayed away from intentionally since late last year. Don't get me wrong, although many of the smaller more speculative names we added to our list throughout the month of January are underwater, we still like all of them from a fundamental perspective on a longer-term basis.

We opted for more speculative names in January in an effort to keep positions light and on the smaller side, which is exactly how most investors and traders should participate in smaller names, so for those of you who've yet to participate in any of current open ideas, now's not a bad time to speculate on them.

Again though, one should only ever allocate to a small or mid-cap cap what one is completely willing to risk, because it's pretty common knowledge smaller names can post some big losses and some big gains in a much shorter timeframe than their large and mega-cap brethren.

On the fundamental front, there's been a tremendous amount of chatter out there from the financial media continuing to blame the possibility of much higher interest rates as we move through 2018. There's also a lot of chatter regarding concerns over inflation as well. However, we simply do not believe either should be blamed for the markets recent downturn.

We've been around the markets for decades, and have experienced every single market crash dating back to the Internet Bubble, and I can tell you with confidence what's happened over the last 10 days has been nothing more than a much needed correction following a run-up that clearly could not last - especially with the way the markets behaved throughout the month of January.

Typically, and it was proven again this time around, when the major indices thrust higher and higher without any sort of minor pullbacks along the way, it's usually always going to end badly, and that's what has taken place over the last 10 days.

What I'm saying here is it's our very strong opinion the recent selloff has had a lot more to do with the above, a concern over recent market valuation metrics, and profit taking in 2018 for those who didn't want to post the capital gains in 2017 for tax purposes.

Why are we convinced of this, rather than the possibly of further developing strength in interest rates and/or inflation? We covered the interest rate issue on Tuesday, which you can read here: https://www.vikingcrest.com/member/newsletter_archives/266.

Basically, we don't see the 10-year treasury yield finding its way too much above the 3% level, and we don't see the 30-year yield rising too much above the 3.5% level anytime soon. The 20-year technical trends of both yields just don't suggest it's possible at this point - not without backing off significantly first.

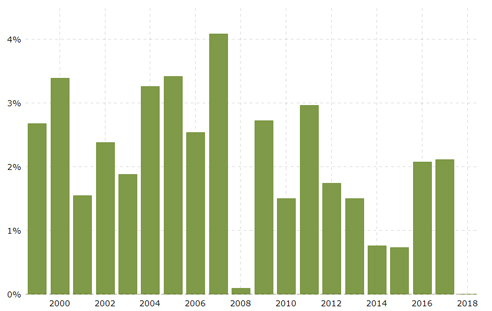

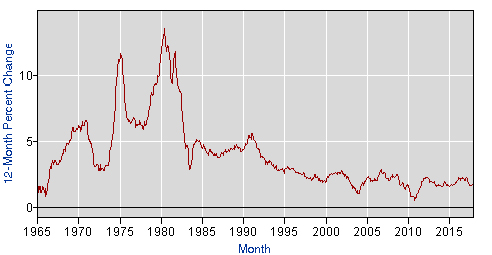

As for inflation, the financial media's recent rhetoric regarding inflation is borderline comical to me. Provided here are a few long-term charts of inflation going back several years, and more importantly several decades. As you can see, inflation is nowhere near levels that should concern the markets.

As a matter of fact, we'd have to see inflation find its way to roughly 4% before we'd be convinced the markets would seriously be concerned about it. Why? The last time inflation rose to 4%, it literally was right around the same time the markets topped out in 2007 - a level that was not seen again until 2011.

Although it is entirely possible the markets have already topped out for a while, we'll see many opportunities to make money on significant rallies back to the upside, and potentially even bearish index ETF's and various other shorting opportunities once these markets retrace some logical levels in the weeks ahead.

Let's remain cautiously optimistic from here on out, tread lightly for the time being, and more importantly remain nimble, because that's the one big advantage all of you have over those big bloated funds out there that can't react quickly.

Actions To Consider Today:

Trail gains in any individual company ideas with protective stops you're comfortable with.

Individual Company Updates:

None

To view current open individual company picks, log-in here: https://www.vikingcrest.com/member. Note: short-term ETF trades are only provided within the daily newsletter.

If you have any questions or would like further details regarding any of the information provided above - or anything else you're thinking about buying or selling out there - please don't hesitate to call or email your Rep . at 619-369-9316.

Sincerely,

John Monroe

Lead Analyst @ Viking Crest