True Tales of the Penny Stock Market - Buyer Beware

Published on February 13, 2018 @ 11:32am

The Greek scribe HOMER wrote in the ODYSSEY, of ODYSSEUS' 10 year journey home after the Trojan Wars to regain his kingdom of Ithaca. ODYSSEUS heard a battlefield story of the ISLE of SIRENS and how the mysterious women's seductive wailing drove men to madness. So being a cautious man, ODYSSEUS strapped his men to the ship, tying himself to the mast. As they passed the ISLE OF SIRENS, their alluring song had the men screaming, desperately straining against their bonds only to leap to their deaths. The bindings held, and the ship passed the danger.

True story or myth? The veils of time obscure that answer, but a cautionary tale for sure. And so it is with the journey of penny stocks. The seductive potential of gaining great riches, risking only pennies a share.

Let's be honest, individuals do not have limitless funds to invest. Sky high prices per share of blue chip, large, medium and even some small cap equities, restricts the number of shares an investor can afford. On the other hand, an investor's ability to purchase tens of thousands of shares is quite alluring. After all, if one bought shares at $.03 there should be no reason $.09 $.10 or even higher couldn't reasonably be achieved in short order; creating glorious, life changing wealth. What could be more seductive than that? Examining a company's 52 week price range might reveal that not long ago that equity indeed, did trade at those prices. Ahhh, but how it got back to $.03, therein lies the rub.

Let's dig down a little deeper and take a look at that. First of all, who are these people offering the public a "once in a lifetime" opportunity? Do they prefer a disruptive, industry changing technology, product, service or cure? A good example would be UBER in the transportation sector, rendering the traditional taxi service rapidly to the edge of extinction. Or there's Amazon sending brick and mortar retail into a tailspin. Well, you decide if the penny stock your looking at has any of these qualities.

But perhaps your due diligence research should ask these questions to fill out a CEO's reputation:

1. Have they had previous companies and what happened to those?

2. Did the company drastically alter its core focus? There's a plethora of penny stock companies out there that have gone from one completely different type of business to another - literally. Once an energy company to now a technology company. Once a consumer product to now a commercial services company. The list goes on. Come again?

3. What is the expertise of the founder, CFO and executive staff? Or is this a one man band sharing an office with a spouse and friends?

4. Ditto for Board of Directors(BOD)

Now onto the Isle of Sirens, the source of the penny stock seduction.

1. Is there any backing from institutions: banks, mutual funds, hedge funds. And no, contrarian organizations that short the stock don't count as financial supporters.

2. What percentage of shares are held by the great leader, his family and the BOD

3. What's the churn of these stockholders? Remember, free shares allocated to executives and Board members just for being on board when the company's IPO went public means any sale, at any price, would qualify as pure profit. The stock price rises nicely, retail outsiders spot a previously undiscovered "gem". And jump in.

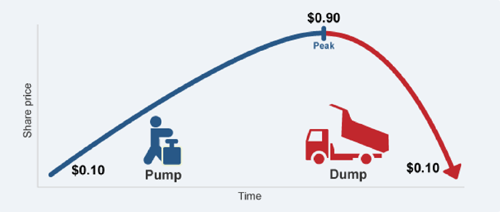

Perhaps the share price will rise for a while, but inevitably a sudden, very large, and inexplicable crash happens and the unsuspecting outsiders get scalped. The stock drops; the unsubstantiated high price never to be seen again. Oh yes, the initial shareholders did very well. How long this ponzi scheme lasts depends on the popularity and gullibility of retails investors. Look for the well timed, paid for, pump and dump publications to prolong this myth.

Now let's hear the seductive Siren's Song; show me the money.

The historic S&P 500 multiple ranges between 15x 18x times share price to earnings. Growth companies often have much higher share price to earnings multiples because as early stage entities they offer great future earnings. Some built a better, more attractive, mouse trap and start making money hand over fist. Despite not showing a profit for years, their growth rate is so spectacular, turning a profit is almost irrelevant. Google, Amazon, Netflix and Facebook, the FAANG are perfect examples.

So is owning tens of thousands of shares, believing you're getting in on the ground floor comparable? After all, these penny stocks have the same skyrocketing multiples as the previous noted companies. It's human nature to believe you might have captured lightning in a bottle with one or more of these pink,or OTC penny stocks.

But is cheap really cheap? Is the risk/reward really in your favor? Let's see...

First you hear of an Initial Public Offering. Price is set, and the company becomes a public player. This is the sweet spot. It often attracts the attention of hedge funds looking for instant beta; the promise of substantial returns on the future success of a company. If the company is perceived to have remarkable potential, the market makers hop aboard for the ride. However, even the best projections can quickly head south when execution falters. Twitter, which recently has been making something of a comeback, is a good example of the expectations for monetizing a popular service which never really materialized. But this was never a penny stock, just a good example of how quickly expectations evaporate.

Penny stocks in the biotech sector are good examples of the thrill of victory and the agony of defeat ( sorry, borrowed that famous quote from a Winter Olympics announcer long, long ago). Life and death for these companies, like their research, is totally dependent upon the fickle, unpredictable FDA ( Food and Drug Administration) Either the developmental biotech R&D meets projected end points..."Hits a home run",creates terrific profits for it's patient investors, or fails miserably and the share price takes a dive and never recovers.

Do these fragile pink, OTC seedlings have any money besides the cash from the IPO? Is there a cash flow? Like any family's budget assets to debts are key. A solid ratio is at least three or four to one assets to debt should be considered. What about expenses, including expense of interest from borrowed money. Does the cash burn rate exceed the income? How long can they survive with a dubious balance sheet, inconsistent cash flow and the expected struggle against bigger, better funded, well established competition.

A common merry-go-round penny stock action is secondary public offerings; meaning more shares flood the market, dilute share prices, only to be followed by reverse splits, which raise the share price, but cut deeply into those tens of thousands of shares you once owned. I've seen anything from 1-5 reverse splits to 1-1000 reverse splits. Stunning. An investor feels manipulated and the new higher price often slowly melts away. Less shares, dropping price. That's a Siren Song that can drive an investor to madness.

A penny stock that shows signs of a broken share price are symptomatic of a broken company. More often than not, only the first in and the first out has a chance to reap the rewards of their game. The rest are left holding the bag and waiting, hope against hope, that brighter days are ahead. Unfortunately, those investors become resigned to those once grandiose dreams of life changing wealth creation, to year end tax write offs. Be careful out there. The pink sheets and OTC are littered with obstacles for the investor seeking a lucrative return on investment; and a safe, return home.

The truth is if you're willing to gamble, then penny stocks might be for you. It's not as if you can't make money in them, but it's important to remember when it comes to investing in the stock market, good companies with good fundamentals usually always will win in the end, and most of those just don't exist in the penny stock world.

Here at Viking Crest, we pride ourselves on just that - identifying good quality companies with good fundamentals, and more importantly finding those good companies with attractive forward growth potential. This is our internal research mantra - to find those quality stocks before others that offer an undervalued opportunity and/or a tremendous forward growth opportunity.

Whether you're new to the stock market, or a seasoned veteran, we're so convinced you'll find our research to be of great value that we're willing to extend to you a FREE two-week trial - no strings attached and no credit card required.

Simply go to our free trial registration form here: https://www.vikingcrest.com/register, and see just how we help folks like you make more money in the stock market.