Financial Media Works Hard with Scare Tactics - Truth About Interest Rates

Published on March 1, 2018 @ 7:40am

The markets continued their short-term downtrend yesterday despite another gap up in early morning trading. That's the second consecutive day the major indices opened higher, only to close substantially lower. And, although all of the major indices are still in a position to move higher on a long-term basis, we're likely to continue to see a little more downside in the interim. More on what we're seeing from a technical perspective in a second.

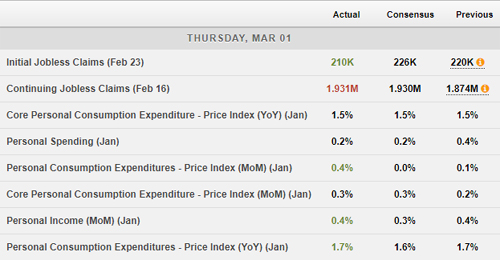

First, we got some key economic data points earlier this morning, but rather than going into all of the detail, the bottom line is everything is still pretty much inline. Everything from jobless claims to personal consumption suggests the economy is still in a very modest growth phase, which you can see in the table provided below.

On the interest rate front, although there continues to be an awful lot of see-saw financial media rhetoric regarding rates, we've continued to reiterate the Fed isn't likely to trigger all that much change in interest rates on a long-term basis. We've covered this extensively in recent newsletter editions, but we'll go ahead and point your attention again to something we've mentioned on several occasions in recent weeks.

Provided here is a daily chart of the 10-Year Treasury Yield. We previously suggested once the 10-Year got close to 2.95%, it would likely back off again, as that's literally where a very long-term trend line exists on its monthly chart. Sure enough, it has once again started backing off that level - unable to even achieve the 2.95% level over the last couple of days.

The bottom line is the much bigger historical picture still continues to suggest rates to be favorable for stocks. To prove my point, provided below is a monthly chart of the NASDAQ Composite and a monthly chart of the 10-Year Treasury Yield.

Even if you go back to late 2013 when the 10-Year breached the 3% level to the upside, the markets continued to raged higher in February of 2014 before dramatically pulling back in March and April of the same year. The result was that April low served up a significant rally that lasted well over a year before the major indices entered a deep correctional phase in the back half of 2015 and into early 2016 - just before the markets staged one of their most impressive rallies in recent history.

So can we blame rates for the markets behavior in recent weeks, or more importantly the last few days? No, because like I just mentioned above, the 10-Year has been backing off over the last few days, and stocks are still moving lower. At this point, it's all about price action and short-term technicals. Meaning, stocks go up and stocks go down, but we're still convinced the markets will eventually move higher when it's all said and done.

With that, when we drill down into the very short-term trading activity of the NASDAQ Composite, which will likely continue to lead these markets in both directions, we could potentially see a move to just below the 3/8th's or even the 5/8th's retracement levels you see in this daily chart here. This would put the NASDAQ somewhere between roughly 7,100 to 6,900, and it would be at that point we'd likely suggest another new long-term idea or two, as well as an entry into a bullish leveraged index ETF like TQQQ or SPXL.

As for commodities, the dollar is clearly in short-term rally mode, so it's strongly suggest traders stay away from any bullish commodity trades for the time being. That will eventually change, but at this point the markets are clearly showing the investment community that inflation isn't an issue either right now.

Lastly, it's probably a very good idea to ignore the financial media's rhetoric, and more importantly the scare tactics many of them have continued to spew in recent weeks following last month's abrupt selloff, because we're strongly convinced what continues to take place across the major averages will only end up being a nice buying opportunity when it's all said and done.

For now, let's continue to sit tight and look for a new tradable bottom - one that may also serve up some nice short-term trading profits in many of the bullish leveraged index ETFs.

New Actions To Consider Today:

None

ETF Trading Updates:

None

Individual Company Updates:

None

To view current open individual company picks, log-in here: https://www.vikingcrest.com/member. Note: short-term ETF trades are only provided within the daily newsletter.

If you have any questions or would like further details regarding any of the information provided above - or anything else you're thinking about buying or selling out there - please don't hesitate to call or email your Rep . at 619-369-9316.

Sincerely,

John Monroe

Lead Analyst @ Viking Crest