Numbers Don't Lie - Stocks at Key Pivot Point - Technical Tea Leaves

Published on July 23, 2018 @ 8:10am

We got more short-term consolidation across the major indices on Friday, as the markets prepare for what is arguably the most important earnings week this season. We've got GOOGL set to report today, LMT and T tomorrow, F, GM, FB, BA, V and AMD on Wednesday, INTC, MCD and AMZN on Thursday, and finally XOM and TWTR on Friday - just to name a few.

As for our current open ideas, we've got BMY, EQNR, NOK and UCTT all set to report on Wednesday, which we'll cover heading into those numbers. All of these names continue to suggest undervalued opportunities with good potential forward growth, but we'll definitely need to see some strong numbers if they're going to starting making some big moves to the upside soon.

With Alphabet (GOOGL) being among the most important stocks for tech earnings this week, you can see on this weekly chart here - despite some major volatility earlier in the year, shares of the tech conglomerate once again found another new all-time high last week.

The Company is expected to report a slightly higher number than what was initially expected last quarter - when the Company actually ended up crushing earnings estimates with a 43% upside surprise.

Can they do it again? Sure, but that's a pretty lofty upside surprise to pull off again. Therefore, we don't think it's necessarily a good idea to play the stock heading into today's numbers, because even a slight beat might not be enough for the stock to move higher on a short-term basis.

To date, 17% of the companies in the S&P 500 have reported actual results for Q2 2018. In terms of earnings, more companies are reporting actual EPS above estimates (87%) compared to the five-year average. In aggregate, companies are reporting earnings that are 4.5% above the estimates, which is also above the five-year average.

In terms of sales, more companies (77%) are reporting actual sales above estimates compared to the five-year average. In aggregate, companies are reporting sales that are 1.4% above estimates, which is also above the five-year average.

As you can see, the numbers have been pretty darn good to date, and analysts currently project earnings growth to continue at about 20% through the remainder 2018. However, they predict lower growth in the first half of 2019.

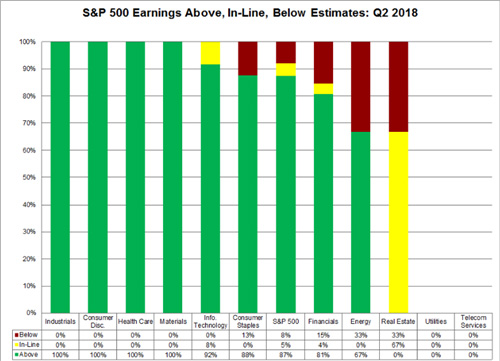

When you drill down into which sectors are performing best, a picture's worth a thousand words. Provided here is a bar chart of S&P 500 earnings surprises as of last Friday. As you can see, it's been industrials, consumer discretionary, healthcare, basic materials and tech that have delivered the largest number of upside surprises - with financials, energy and real estate having delivered the largest number of downside surprises so far this quarterly reporting period.

With respect to the current fundamental landscape, the bottom line is the numbers are there for the markets to continue higher on a go-forward basis.

Technically, it's a bit of a mixed bag until the DOW can finally find its way convincingly above the 25,400 level - a level we've continued to reiterate to be the most important level traders should be focusing on right now. Not only would a strong break above that level negate a potential long-term sell signal, it would suggest these markets will continue to make new all-time highs again. However, until that happens, it's still not a good idea to get too overly excited about the markets' recent short-term bullish trend.

Provided here are daily charts of both the S&P 500 and the DOW. As you can see, the S&P 500 has clearly been performing well of late, despite this morning's early pullback below its 3X3 DMA (blue line) - all while the DOW still continues to struggle to break above that key 25,400 level (horizontal blue line).

However, all it would take is for most of the above mentioned stocks to start moving sharply higher on the heels of their earnings reports this week, and it could be off to the races again. Until then, we'll continue to tread lightly.

The bottom line is if these markets are going to start to stage another leg up, and more importantly drag the DOW above that all-important 25,400 level we continue to reference, this is the week it should happen.

ETF Trading Actions/Updates:

Both of our short-term commodity ETF trades via UCO and UGLD continue to perform well enough - with oil moving higher today, and gold taking a bit of a pause following late last week's reversal back to the upside. Therefore, we'll continue to hold UCO - with a price target of $76 on the price of crude. We'll also continue to hold UGLD - with a target TBD.

Individual Company Actions/Updates:

None

To view Current Open Picks log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst