Market Malaise - Building Argument for Commodities - Tech Fizzles

Published on November 19, 2018 @ 8:33am

FREE ARTICLE - TRY THE REAL THING FREE FOR TWO WEEKS - NO CREDIT CARD REQUIRED: https://www.vikingcrest.com/register

Not a bad day for the major indices on Friday, but not a great day either. Stocks just can't seem to get out of their own way - with the real issue of valuation and near-term growth concerns becoming more and more of the dialogue within the financial media. It's something we've been talking about for at least a few months, and it's finally starting to surface out there.

However, there are still a number of technical and fundamental reasons we've referenced lately that could end up providing enough of a catalyst to potentially take these markets higher again. Specifically, despite the fact many of the more darling tech and popular growth stocks have gotten pretty long in the valuation tooth, there's still a LOT of companies out there offering great value on both a short and long-term basis. The problem is they're just not performing yet.

The recent earnings season has for the most part come to an end. Now, stocks can start trading on their forward merit again. However, the technical landscape is still a bit of an issue, and until that starts to show far more promise on a short-term basis, we continue to exercise patience - with exception to a few contrarian ideas we've put out there lately.

Like I just mentioned above, Friday's activity wasn't bad and wasn't great. The NASDAQ, which has led these markets all along, has come under pressure. More importantly, there's no real leadership taking place there now that the FAANG stocks' narrative has switched from one of tremendous hype to one of many small concerns.

Facebook is still the subject of regulators. Apple has reportedly cut iPhone production. Analysts continue to cite concerns regarding Netflix's ability to maintain its growth. And, the Trump administration is starting to scream anti-trust on mega cap tech plays like Alphabet and Amazon.

Still, in my very humble opinion, all five FAANG stocks should continue to be owned, and more importantly should become even more attractive the lower and lower they potentially go. However, none of the above is helping tech on a near-term basis yet.

Provided here are daily charts of both the NASDAQ 100 and the S&P 500. As you can see, following both of their bottoms a few weeks back, neither have yet to really provide any significant follow through - with the S&P 500 having outperformed its tech peer ever since.

At this point, we continue to believe SPY and DIA will outperform QQQ until proven otherwise. Meaning, the primary benchmark ETFs tracking the S&P 500 and the DOW are likely to provide better returns in the weeks and months ahead than that of the NASDAQ 100.

Of course tech is going to end up coming back into favor in a big way, but it remains to be seen as to exactly when that's going to happen. Until then, we still really like healthcare, biotech, energy and commodities in general on a go-forward basis.

The demographic is clearly going to be there over the next few decades for healthcare and biotech - with aging Boomers, including myself, not getting any younger. We also continue to point to the fact we strongly believe we're still in the very early stages of a long-term reflationary economy, which should end up being good for everything commodities.

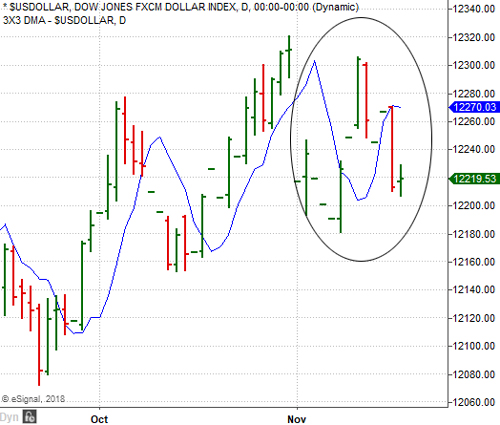

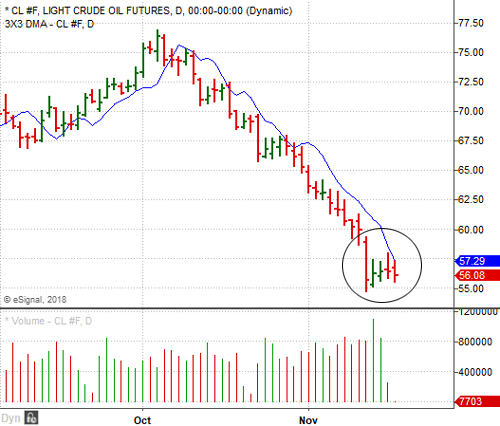

On the technical commodity front, provided here are daily charts of the US Dollar Index and the price of crude, as well as a weekly chart of the primary ETF tracking gold in GLD. The dollar finally started to cooperate last week by reversing itself back to the down side by week's end. Although that still didn't do much to help the price of oil, it did provide a bit of a bid for gold.

You can see here oil is clearly working to find a base and potentially build a bottom, but it remains to be seen if the $55 per barrel level is going to be the ultimate bottom. We have many fundamental and technical reasons to believe it will, however, we are going to need oil to snap back in extremely sharp fashion if we're going to take advantage of momentum traders piling in soon. We do, however, believe there's far more potential upside ahead in oil that there is downside at this point.

As for gold, there's a reason we've provided a weekly chart of GLD here instead of a daily chart. In short, if GLD closes above its 3X3 DMA (blue line) at the end of this week, which currently sits at $116.48, it will have confirmed a long-term reversal signal. Meaning, gold and precious metals in general could start to rally significantly soon.

To be clear though, we can't jump the gun and assume GLD will close above that level by week's end. At this point, it's very possible, but until it does we simply can't run out and start buying up precious metals yet.

John Monroe - Senior Editor and Analyst