DOW and S&P 500 Pick Up Downside Steam - Targets Reiterated - Leveraged ETFs Op-Ed

Published on May 13, 2019 @ 1:50pm

A new week, but no new theme for the broader markets. Legendary trade Jesse Livermore said, "Another lesson I learned early is that there is nothing new in Wall Street. There can't be because speculation is as old as the hills." Frederick Douglass said, "There is no progress without struggle and power concedes nothing without a demand." Here's what's going on and what we're seeing ahead in and around the broader markets to kick off a new week of trading...

Markets are Fixated on Momentum and Sentiment - Not Fundamental Change

Still no deal on the China/US trade front. As a matter of fact, it now appears both are going backwards in their negotiations - with China and the US increasing their tariffs on each other's imported goods now. A bit of a surprise, but regardless it sure looks like both sides are playing their best game of geopolitical chicken at this point, which continues to suggest the recent shift in market sentiment and momentum is picking up more downside steam.

The good news is we're still convinced from purely a long-term technical perspective these markets are going to find new all-time highs at some point this year. The problem, however, is just how much more downside lies ahead before they do?

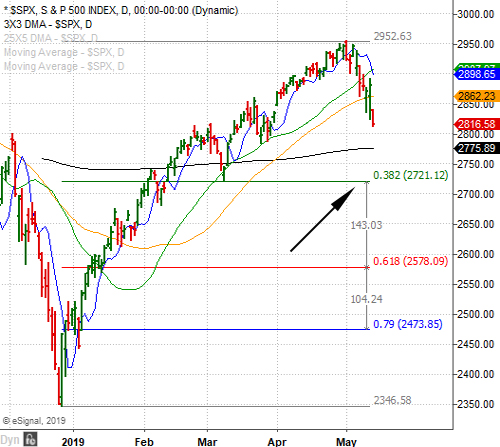

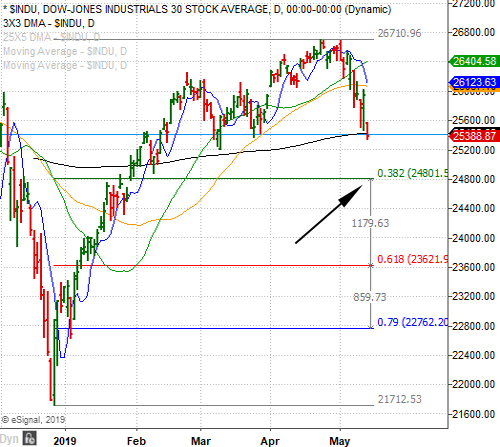

At this point, our previously published downside target of 24,800 on the DOW looks to be the next logical stop. Provided here are daily charts of the S&P 500 and the DOW - both pointing to the first line 3/8ths retracement levels from their December bottoms to their all-time highs.

Therefore, there's no material change in our ongoing open short of the DOW via SDOW until a point in time whereby the S&P 500 and/or the DOW achieve the above mentioned retracement levels. Or, something extremely definitive changes from a technical perspective to suggest the recent bearish trend is over.

Flight to Bonds in TLT and Some Comments on Options in General

We mentioned on Friday a call options trade in TLT, the primary ETF tracking the 20+ Year Treasury Bonds. Specifically, a $131 strike price with a June expiration. However, when you consider exact prices are often a pretty tough task to peg to the number in any stock or index, just remember if and when we ever suggest an options idea we're assuming those who participate in them now exactly what they're doing.

In other words, you don't always have to wait for the perfect exit price, as you've got to consider what's happening and just how volatile things can be on a short-term basis. You also have to be willing to set a protective stop in the event the idea in question gets away from you. Therefore, you've got to take the profits when they're there and remember... bulls make money, bears make money, but pigs gets slaughtered.

Provided here is a monthly chart of TLT, and as you can see we've pointed to that $131 level. Although it's possible, it's not likely to get there in a straight line. However, considering bonds are often a flight to safety, we're still pretty convinced the $131 should be easily achieved as long as the major averages continue to move lower.

Since bonds are as sure of a return as anything in the markets, they do become a desired vehicle when stocks look to be moving substantially lower. It's just that bonds will never provide the type of returns you will find by being in the right stocks at the right time.

Advantages of Trading Leveraged ETFs On a Short-Term Basis - SDOW Comments Again

We've already made it very apparent over the years that bearish leveraged index ETFs are also a fantastic way to protect against one's long-term portfolio of bullish ideas, but they're also fast becoming the vehicles of choice for swing traders looking to scalp gains in a short-term bearish environment - with the bullish leveraged ETFs obviously becoming the choice in a short-term bullish environment.

I say short-term because leveraged ETFs are NOT designed to be long-term investing vehicles, as they erode with time - just like options. And, the moves in them can be so swift one must address their trading strategy and timeframes. Meaning, you can trade in and out of them throughout the week or simply enter into one when a trend has changed and stick with it until the trend has changed again.

If you're going to do the former though, you're going to have to be willing to accept the big swings that will continue to take place in them until a point in time the leveraged ETF in question has either achieved a specific target level, or the trend in question has actually confirmed a change.

Regardless, we do find leveraged ETFs to often be better short-term trading vehicles than individual stocks, because it's much easier to predict what a large basket of ideas will do rather than what one individual company stock is going to do. Basically, the bigger and broader of a basket one can technically assess, the easier it is to predict on a go-forward basis.

The bottom line is until the current bearish trend has actually confirmed a technical reversal, we're not interested in taking SDOW off the table. SDOW is not only serving as an opportunity for traders to pick up some short-term gains, it's also serving as protection for investors looking to hedge against their long-term bullish ideas.

Maybe that trend change comes around 24,800 on the DOW or maybe it doesn't. Therefore, we'll stick with SDOW until proven otherwise.

To view Current Open Picks log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst