Rules are Imperative to Success - Especially in the Stock Market

Published on June 21, 2019 @ 9:03am

Experience has taught us certain rules are well worth considering if you're looking to be successful in the stock market. Of course those rules can be very different depending on whether or not you're a short-term swing trader or a long-term investor, but the fact remains if you adhere to a solid set of rules and disciplines, you're likely to become far more consistently successful - now and well into the future.

First, I just wanted to mention the importance of something we've relied on for years to be accurate and effective when it comes to helping traders and investors consistently become more successful.

Although charting and technical analysis has been a big mystery for many years, the concept is really starting to become mainstream, which is good for us and good for you.

Why? Although many like to make claims of being expert technicians, the truth is most continue to focus on certain technical tools and theories that recent history has proven to be ineffective, or at the very best moderately reliable. Meaning, there's an awful lot of old and unreliable tools out there many think work well, but simply don't.

However, if you're willing to take the time to learn what actually works, the proper analysis and methodologies can give you the type of edge that will allow you to spot trend reversals before the rest of the heard, an opportunity to sell when maybe others are piling in at the wrong time, and more importantly give you a great indication of what to consider and what to ignore - no matter how fundamentally solid the idea in question is.

Charting and technical analysis can also be a fantastic way to identify and assess where big money is flowing before the actual fundamental reasons ever start to surface. Remember, stocks and the markets in general often trade well in advance of what's to come, so it's usually the smart money that's going to start to reveal what's on the horizon long before the fundamental landscape actually starts to develop.

It's been very well documented for years here we're huge fans of charting and technicals. So much so it's become more and more of our focus here, and for good reason. While fundamentals often tell us which stocks to buy, it's the charts and technicals that tell us when to buy them, when to sell them, and when to ignore them.

I find it fascinating now that everyone from Jim Cramer to other Wall Street pundits on CNBC are starting to share their thoughts and analysis on charting technicals in an effort to better identify when's a good time to buy a stock and when's best to ignore a stock. I've made my living in and around the stock market now going on 20 years, and never have I ever seen so much commentary and analysis on charting technicals in the media like I have over the last few months.

I've said for a long time the advent of the Internet and all of the technology associated with real-time data and charting these days has provided professional traders and investors a significant edge using this fascinating and often reliable form of analysis. And now that these markets have entered a time period of extreme volatility and uncertainty, everyone out there is looking for that extra edge, so of course the media is starting to finally exploit it.

The bottom line is although fundamentals are clearly important when it comes to multi-year long-term investing in any stock; literally nothing is more important to the near and mid-term landscape more than charting and technical analysis.

Of course nothing in the markets is 100% reliable 100% percent of the time, but if you're willing to pay close attention to the charts, and assess things without any emotion whatsoever, you're likely going to put yourself in that top 20% of the investing population that makes 80% of the money.

This is precisely why we work diligently to not only bring you timely and reliable technical and fundamental analysis day in and day out with respect to the broader markets, the sectors associated and the plethora of individual stocks that make up the markets, we also make a big effort to try and educate you all along the way.

At the end of the day for us, it's all about helping you become more profitable, and ultimately help you become a more knowledgeable investor or trader - whatever your strategy might be. Like the old saying goes, give a man a fish, feed him for a day, teach a man to fish and feed him for a lifetime.

Rest assured, we spend countless hours assessing the markets and thousands of individual quality fundamental names in an effort to pinpoint when's the best time to participate in those names, and ultimately give you the kind of edge it takes to be consistently successful. We're clearly not always right, but it just goes to show just how much time it takes to spot potentially profitable opportunities, while reducing the potential risk as much as possible.

After years of helping professional investors and traders make better decisions, and ultimately more profitable, here are 10 of our most important rules we’ve found to help even the savviest individual.

-

Before you ever decide to participate in any idea you must determine in advance whether it's going to be a short-term trade or a long-term investment. If it's a short-term trade, make sure to pre-set your parameters. Plan the trade and trade the plan based on your own risk tolerance and desired strategy. Meaning, a protective stop loss and a reasonably acceptable target. If it's a long-term idea in a VERY HIGH QUALITY name, be prepared to exercise patience and don't be afraid to average down in the idea if it ends up moving lower than 20%, but not before.

-

Fundamentals tell you what to buy. Charts often tell you when the best time to buy them is. Remember, nothing drives the short and mid-term landscape for anything more than momentum, sentiment, fear and greed. However, in the long run fundamentals always win. This is why it's so vitally important you pre-determine your strategy in any idea - no matter what we or anyone else says about the stock in question. It's your money. The worst thing that could ever happen is having a short-term trade gone wrong that ends up becoming a long-term investment. Don't be afraid to cut losers and don't be afraid to ride winners, but never ever let winning trades turn into losing ones.

-

If you're a long-term buy and hold investor and you hold in excess of 15 individual names, you're probably better off consolidating those holdings into a few multi-year outperforming ETFs like QQQ and SPY, because the chances of a portfolio with too many names outperforming the NASDAQ 100 and/or the S&P 500 is probably pretty slim.

-

Predetermine how much of your portfolio is allocated to long-term investing and/or short-term trading. Also, predetermine your personality's risk tolerance and patience. This will go a long way toward helping you be successful. Most investors and traders have no real idea of what they’re strategies, timelines and goals are. It’s imperative every individual assesses their own personal risk tolerance, timeframes, goals and strategies. Rather than thinking about how much you might make on an idea, think first about how much you might be willing to lose in the event the idea in question goes wrong. Then, determine if it’s something you’re willing to hold for years, or simply hold for a short to mid-term trade. Keep your expectations realistic, because there’s no bigger place on earth than the stock market where rhetoric (both positive and negative) runs more rampant. Don’t buy the hype. Rather, make sure you have solid context technically and fundamentally for the stock in question. The more reasons you have to make up your bullish or bearish context for an idea, the higher the probability for success will be for the idea in question.

-

Avoid companies that haven't proven much of anything on the revenue and/or earnings front - no matter how sexy the story might be or what anyone else says. If the Company in question isn't profitable, it better have enough cash on the books to see its way to profitability. Also, avoid companies with astronomical debt levels compared to cash on the books. You can easily look up a company's balance sheet and valuation metrics at sites like Yahoo! Finance by clicking on the ticker symbols statistics or financials. Unless it’s a development stage biotech with a LOT of cash on the books, the Company must be generating millions per quarter in revenue! If it’s not, that’s a major concern.

-

Unless you love to gamble and lose, it's probably a very good idea to avoid penny stocks like the plague. Most of them are probably going to end up out of business, and that's no way to build a solid portfolio for the future. Again, rather than thinking about what you might make when considering an idea, first determine what you're willing to completely lose and go from there. Many novice investors gravitate to penny stocks because they think a small stock can get big faster than a big stock can get bigger. That couldn’t be farther from the truth. There’s a reason penny stocks are penny stocks, and it’s usually because they have no revenue and/or earnings to speak of, and they have poor cash balances on their books.

-

Keep your emotions completely out of your trading or investing. Be realistic and see things for what they really are. Nothing can destroy a portfolio faster than pipe dreams or unrealistic expectations. Put in the necessary time depending on your strategy and keep things real.

-

Take the three to five minutes every single day to read our daily report - not only will this keep you well on top of what's going on in and around these markets every day, it will ensure you don't miss something important regarding a new idea or any previously suggested ideas.

-

You don't have to participate in every single idea you read or hear about. It's almost impossible unless you have an unlimited amount of funds. Even then, you should only ever participate in an idea your intuition and intelligence is telling you to participate in, and you understand a realistic context for the idea in question. In other words, if we put an idea out there and you really like the context of why we like the idea then participate in it. If something is telling you not to or the context isn't strong enough for you simply ignore it. Sometimes less is more. However, it is VERY important to read why we like something in its entirety before ever participating in the idea in question. We are not a portfolio management service. We cater to those willing to make their own decisions and willing to take the time to stay on top of the markets and further their education by staying well on top of our daily reports via email.

-

As for our open ideas, when we suggest them we tag the idea in our open picks section with either a mild, medium or aggressive allocation. This is a representation of where we believe the major indices are in their long-term cycle. Mild is a late stage bull market. Medium is a mid-stage bull market and aggressive is often a bear market that’s bottoming.

Excerpts from 9/20/2019 Newsletter Edition - Biggest Portfolio Killers and Tips Reiterated

I get an awful lot of emails and phone calls from time-to-time from many of you with questions regarding trading/investing strategies. I also receive many inquiries and questions from many of you looking for a second opinion on an individual stock you own, on something you’ve heard about elsewhere and/or are thinking about buying now.

With that, I've assembled what I believe is a very short list of the biggest portfolio killers, and a short list of tips on how one can improve their short and/or long-term portfolio performance.

First and foremost, many investors and traders participate in WAY too many overly speculative small and micro cap stocks that literally haven't proven their ability to substantially grow revenue and/or earnings. It's typically not a good idea to buy something just because someone has a great story about it. I prefer to focus on companies that actually have proven their fundamental worth already, have the necessary financials to grow their business, and do appear to have attractive forward growth prospects. Add all of that to a potentially attractive technical landscape, and you have a much higher probability of success for the idea in question. Even then, you or I are not always going to be right, which leads me to the next big tip.

Basically, it's imperative you participate only in high quality fundamental names and ETFs that trade high volume that are still fundamentally and/or technically attractive. The old adage buy low and sell high is all fine and good, but if you're not participating in proven companies and/or ETFs that have proved performance worthy, and are liquid enough to get in and out of them whenever you want, you're probably asking for trouble. I love to speculate as much as the next guy, but I will only speculate on something that has actually proven more than just a little fundamental something, and does appear to be technically attractive for more than just one reason.

Further, many investors and traders have a tendency to hang on to their losers way too long - especially when it comes to those overly speculative small and micro caps that haven't proven much of anything. There's absolutely nothing wrong with holding something for the long haul, as long as it's a very quality name that continues to prove it's still a good idea to hold it from a fundamental perspective. Cash and debt on the books are a big tell for any company, so it's always important to look at those two line items before deciding if you're going to continue to hold something or not. There's nothing wrong with cutting an idea when an idea goes south. We've all hung on to losers far longer than we should have at times, but that's human nature - we don't want to accept a loss. Trust me, it's better to cut something before the losses really pile up on the wrong idea.

Another one of the biggest market no-no's is being way too overly active - participating in just about anything and everything that comes your way - no matter where it comes from. I can't emphasize how important it is to be selective, and know when patience is warranted. There's nothing wrong with doing nothing sometimes - especially when the current market environment isn't offering any sort of definitive direction. As for us, remember, we're simply a source of ideas to help you be successful in the markets, so it's very important you only ever participate in those ideas you have strong conviction for after reading the context here in the newsletter for why we like the idea in question.

Know your strategy and stick to it. Play the long game or the short-term game, or a combination of both, but pre-define the strategy on the idea before you decide to enter. Hindsight is always 20/20 so don't spend too much time on the coulda shoulda woulda unless there's something definitive to learn from it. Know your strategy in advance of buying or shorting anything. In other words, before you actually buy or short something, determine in advance if you're going to invest in it for the long haul, or if it's simply a short-term swing trading idea you're going to attempt to shave for some profits.

Lastly if you don't fully understand how the options markets work, don't buy or sell them. Everything from liquidity to implied volatility are important toward determining whether or not an options trade is worth the risk. Consider the timeframes, and always give yourself ample time that makes sense based on the cost of your options' purchase - all in an effort for those options to end up being profitable. It's enough to identify an attractive fundamental idea that is starting to look technically attractive, but oftentimes it takes time for the idea to play out. Meaning, when you add time to the equation things become even more difficult - yet many investors and traders get sucked into buying options because of how much leverage and how profitable they can be when right. Sometimes, it's better to just be a seller of options rather than a buyer of them.

Excerpts from 2/21/2020 Newsletter Edition: Anticipation Vs. Confirmation - Positioning Power - Options Chains Often Don't Suggest What's Really Happening

Before I get into the meat of today's edition, I want to cover a few things I think can help every single trader and investor out there - no matter what your strategy might be. Whether you're looking to learn how these markets actually work, or you're simply looking to expand your already astute knowledge of how these markets work, there's something valuable in every section of today's newsletter to help you accomplish that.

First, I often talk about waiting for confirmation vs. trying to overly anticipate things too much all of the time. One might think those are two in the same when it comes to the equity markets, but there's actually a big difference between the two. Anticipating is jumping on something because of the way something is behaving in a minute or a day, while waiting for confirmation is actually waiting for something technically definitive to confirm itself before making a move.

All too often traders and investors will make knee-jerk decisions, only to end up being whip-sawed very quickly. Will they be right from time-to-time and capture more gains in the process? Sure, but hindsight is always 20/20. The truth is when a trader or investor actually waits for definitive confirmation, they're going to be right far more often than they're wrong. Sure, the more disciplined traders and investors are going to give up some gains sometimes by waiting for confirmation, but in the end they're going to consistently be a LOT more successful.

When it comes to something I call positioning power, I think it's prudent to wait for extremes for the timeframe and instrument in question. Meaning, when we jump the gun too soon (no matter what the chart timeframe in question is), we often can put ourselves in a position that's not optimal.

In other words, when we jump on a short or long trade too soon, and the idea in question moves quickly in the other direction we become trapped. Meaning, now we have to wait and hope for the idea in question to work itself back in the other direction. However, if one waits for an extreme, and then uses disciplined protective stops, they're often going to put themselves in a position of power. And, it's that power that allows them to not only feel more comfortable with the trade in question, but also gives them options.

Don't get me wrong, you could be the best trader or investor on the planet and you're still going to end up in unfavorable positions at times, but that's just one general rule I think everyone should consider before trying to anticipate something too soon.

Lastly, although I'm not a huge fan of options I do want to point out a big misnomer when it comes to the options markets. I see and hear it all of the time in and around the financial media, whereby people say they can tell what's going on with a particular options chain for a company or instrument.

You'll see and hear things like... someone bought a massive number of calls or puts with a strike price of X. However, what nobody really knows is whether or not that call or put purchase is a hedge against a much bigger underlying position - one that's actually meant for the opposite direction. Meaning, if someone buys a large number of puts, many might think that stock is going down when in fact it's merely a hedge against a much bigger bullish position in the stock.

So, just be careful getting sucked into relying too much on how many puts or calls are open or being purchased in an options chain at any given time, and more importantly rely on your charting prowess to determine what a stock is actually in a position to do.

Excerpts from 12/23/2020 Newsletter Edition: Stretching Gains and Flirting with the Markets' Overbought Conditions - Trader/Investor Psychology and Using Stops

While every trader/investor is always looking to achieve maximum alpha, it's never as much about the desire for alpha as much as it will always be about the risk associated with achieving it, and right now these markets have technically extended themselves to levels that will likely end up proving to be overextended within a fairly short amount of time.

It has been well documented here lately that we're not all that far away from our near-term targets of $317 for QQQ and $388 for SPY. They've been the two primary index ETFs that have led these markets for years now, and that's been a good thing for most of you and us. However, it's important at this point to start questioning just how much higher these markets can go before we get a much bigger breather than anything we've seen since the early September selloff.

First, for those of you who have been around long enough, you know we've been as good as anyone out there at calling the short and longer-term tops and bottoms for these markets. I warned everyone in the few months leading up to the selloff that ensued in October of 2018 and was pretty close to calling the bottom in December of the same year. We then called the breakout in October of last year, warned during the two months leading up to this year's February collapse, and then once again got pretty close to calling a perfect bottom in late March.

To be critically fair of my own technical analysis, however, I did not expect the big run that continued throughout this Summer. I strongly questioned these markets' ability to move all that much higher without first staging another big pullback, but instead they kept going until we finally got a big enough breakdown in early September to suggest a bullish reset, and thank God we continued to expose high quality names for some tremendous gains ever since.

What I'm trying to say here is although stocks, and the markets in general, have a long history of moving much higher and lower than most would tend to think, I do believe we're fast approaching fairly concerning levels to suggest another looming selloff at some point soon enough.

Although nobody knows what will actually end up spooking the markets, the one thing we know is it won't be interest rates. Not yet anyway. Another thing those with experience know is that stocks go up, stocks go down, and nothing ever typically goes up in a straight line for long. Couple that with some very overbought technical conditions, and today's newsletter edition is warranted.

Further, when you consider the fact QQQ is now only 2.5% away from our near-term target and SPY is a little less than 6% away from our near-term target, it's important to know we're close enough to those targets to trigger at least a little cause for concern. Why? Because calling perfect tops and bottoms to the number is virtually impossible. As a matter of strong opinion, if one is within a few hundred points on the NASDAQ or S&P of calling a tradable top or bottom, and roughly a thousand points on the DOW, that's pretty darn good.

So how should traders/investors deal with all of it? While there's no question we continue to try and stretch gains from all of our current open ideas (ex SVM of course), our ongoing strategy of taking profits on the run-ups when they're there should continue to serve everyone well. Sure, some ideas will end up going higher on a short-term basis than one would have thought at times, but again nobody has the perfect crystal ball. Instead, it's all about risk management.

With that, I probably receive more questions about protective stops than anything else. Where to use them, when to employ them, and even if they're something traders/investors should trust using. The latter has everything to do with traders/investors having used protective stops before, only to have them taken out, and then watch the idea in question work its way higher.

Trust me when I say though, one person's protective stop is not going to be the target subject of market makers' as long as there's enough volume in the idea. Now if there's enough traders/investors with hundreds of thousands, or better yet millions of shares, sitting around a fairly specific protective stop level, that can be an entirely different story, which is why the old idea of support/resistance levels (when simply eyeing a chart without tools) are often take out to the upside or downside before the idea in question has a strong tendency to reverse.

In short, it's a modern day market maker tactic to clean up very large positions around old support/resistance type levels, and then reverse the idea in the other direction. Many of you here already know this happens all of the time. And, although I know many of you are very accomplished charting technicians, we've got a fairly high number of clients/subscribers who are not, but that's perfectly OK. It's part of the reason many use our analysis here from day-to-day, week-to-week and month-to-month.

So when and where should one employ a protective stop? The first thing you need to ask yourself is are you trading the idea on an intra-day basis, over the course of a few days, weeks, months or even years? That is so hyper-critical to answer first before one should ever try and employ a protective stop. Why? Again, it's not about having a perfect crystal ball - it's all about managing risk. So, you also have to ask yourself how much risk tolerance are you willing to accept in exchange for potentially higher levels?

Once you have answered that question, then you drill down into the chart timeframe in question. In other words, if you're intraday trading then it's all about those minute and hourly charts. If you're swing trading over the course of more than just a few days, then it's more about the daily charts and so on...

Lastly, the most important technical tools to effectively know when and where to place a stop have everything to do with price action, retracement/expansion levels, and then finally those key 14, 50 and 200 period moving averages for the chart timeframe in question, as well as those ever reliable exponential moving averages, or better yet those displaced moving averages we like to use so often.

It's also VERY important to keep the emotions of fear and greed out of the equation, because there's no place for the whole coulda shoulda woulda mentality when it comes to trading/investing. So, when something gets way too far away from those key moving averages on the chart timeframe in question, it's time to take the profits or employ an extremely tight stop.

If you're long an idea, and it starts to back up, then you employ a stop far enough behind the moving average you want to use depending on your risk tolerance. For some, and depending on how much you're up or down in the idea, you may want to use just behind a 14 period moving average, 50 period and so on, but again it's all about the chart timeframe you're trading.

Remember, there is never reward in stocks without risk, and more often than not the bigger the risk the bigger the potential reward. Therefore, it's far more about your timeframes, strategies and risk tolerance than anything else. And then, deciding behind what levels you're willing to accept in the event you or I are wrong.

Right now is clearly one of those times traders/investors should be addressing all of the above, because when these markets do finally decide to take a big enough breather there's the very high probability it's going to come swiftly. That's just the way these markets work anymore, and I seriously doubt that is going to change anytime soon. Therefore, it's hyper-important we make proactive decisions, and be completely willing to live with whatever the outcome may end up being.

Excerpts from 2/02/2021 Newsletter Edition: Most Important Rules to Trading/Investing Now and Forever

As expected, after achieving those last final short-term moving averages on Friday, all of the major indexes bounced sharply to close out the day yesterday. This once again proves a few of the most important rules to trading/investing in this current market environment: remain completely pragmatic/objective about what these markets are capable of, pay close attention to the technicals, and avoid relying too much on one's feelings/emotions.

Basically, all of the major indexes proved their resilience yet again yesterday, and they did it around very logical technical levels. As a matter of fact, it was those last key short-term moving averages yesterday that were expected to serve up a bounce, and possibly even take these markets on to new all-time highs.

Although we've clearly yet to achieve new all-time highs again, everyone should know by now what these markets are capable of. Meaning, no matter what politics are suggesting or what the financial media is spewing, it's still all about interest rates, momentum and revenue/earnings - in that order. Those are the three most important components to the ongoing behavior of these markets, and that's likely never going to change.

Sure, there are going to be unexpected major geopolitical and black swan type events like 9/11 and COVID, but as long as nothing like that surfaces it's still all about the BIG 3 - interest rates, momentum and revenue/earnings. And, anyone that tells you otherwise doesn't have a pulse on these markets. Case in point, it doesn't matter who's President until the President or administration in question changes a policy that could have a dramatic effect on a sector, a stock or the markets as a whole.

With that, it was all about momentum yesterday. However, yesterday proved once again short-term index traders must remain very tactical and surgical - buying the extreme logical lows around the most important short-term moving averages, use tight enough protective stops, and then sell or short the big rips once the instrument in question has gotten too far away to the upside from its key short-term moving averages.

If you can't or don't have the time for that, it's always best to adopt the buy and hold strategy, or simply give an idea enough time to work itself out and then take the profits when they're there, because as long as you're in the right high quality names they're going to work out when it's all said and done.

This also brings me to another very important rule traders/investors should always adhere to: never chase anything higher or lower unless you're getting in during the very early stages of an expected upside/downside expansion. Meaning, depending on your trading/investing timeframe and strategy, it's best to take the profits on the big run-ups, and then let the idea come back to you. Conversely, when you're looking to short something, wait for the big bounce or run-up and short from there.

Although the buy and hold strategy should only ever be focused on two things (buying very good fundamentally attractive companies when the charts look good enough), the short-term trader must always deal with risk management and positioning - especially since things in this market environment are moving VERY quickly from day-to-day.

This is why I prefer to teach short-term traders to use the most important moving averages to make decisions. These markets are making big moves in a very short amount of time - sometimes all in an hour, so the bottom line is it's extremely important for the short-term trader to be proactive rather than reactive. Reactive traders are getting whipsawed in a New York Minute, while proactive traders continue to better position themselves from a risk management perspective.

I know this sounds so cliche but it really is all about buying low and selling high. Sounds simple right? Well, if you've been around the markets long enough, and watched the behavior of new traders/investors along the way, then you know greed, fear of loss, and the fear of missing out can make buying low and selling high a real problem for many.

Therefore, I'd strongly suggest everyone here take stock of their emotions/feelings, continue to stick with their trading/investing timeframes and strategies, continue to remain completely objective/pragmatic about all of the possibilities, and only participate in high quality fundamentally attractive names that look technically attractive at the time. Everything else isn't for me or for us.

If we all collectively do this, we're all going to be far more right than wrong, and more importantly consistent with our success over time - especially if we continue to manage risk accordingly and give the right idea enough time to work out. There's no question very short-term charts can be tricky at times, which is why long-term charts and long-term fundamentals always win in the end.

Excerpts from 2/09/2021 Newsletter Edition: How To Trade Small/Micro Caps, Biotech & Six Names to Consider - RPD On Deck - Markets Run Hot

First, many of you here already know I cut my teeth in this business in the small and micro cap space. I've done it all, I've seen it all, I've made every mistake one could possibly ever make, and I've had glorious winners all along the way. However, all of it has taught me that if one is going to speculate on small/micro cap stocks, he/she must adhere to a certain set of rules:

1) Don't believe the hype. Do your diligence, because the small and micro cap space is littered with companies that will never end up making it when it's all said and done. As a matter of fact, most end up failing over time.

2) Make sure the company in question has enough cash on the books to make it. If you dig into most penny stocks, you'll probably find you've got more in the bank than they do. That tells you right there to run from the idea, and run fast.

3) Be willing to deal with whatever volatility is going to surface in that idea. Most small stocks will gain and lose as much as 30% or more over the course of just a few weeks, and sometimes just a few days.

4) Make sure the company in question actually has a business model to change the world, change lives or change an industry. If it does, then refer to rule #3 above.

5) If you do decide to trade a small or micro cap stock make sure you decide in advance how much you're willing to lose, and where you'll cut the idea if it doesn't work out. Most only ever think about what they stand to make, only for the stock to end up cratering.

6) Also, decide in advance if you're going to stick with the idea no matter how well or poorly it trades, or if you're simply just going to date it for a relatively short amount of time. In other words, plan the trade and trade the plan.

7) Make sure the stock in question is showing some semblance of attractive technicals, and don't chase it higher. In other words, there's got to be something attractive developing on its chart before you consider jumping in.

The bottom line is if you adhere to those above rules (no matter how big or small the company might actually be), then you can catch lightning in a bottle from time-to-time, and sometimes even generate life-changing returns. We've done very well over the years for those who've bought and held most of our suggested small cap ideas, but again it has everything to do with the above rules. And, the gains with those ideas over time typically never came without at least a little concern and frustration along the way.

Excerpts from 3/23/2021 Newsletter Edition: Markets Waffle - It Will Always Be About Knowing Your Strategy, Assessing Probability and Managing Risk

Basically, it's always about the either or scenarios - using technical and fundamental analysis to determine the probability for literally anything and everything in the markets. And, for the short-term index trader it's precisely the above-mentioned scenarios that should not only determine the markets' next move, but when and where one should most likely get short, get long, take profits or set protective stops. For the long-term buy and hold investor, it's all about the same, but it's always more about the longer-term weekly and monthly charts.

What I'm getting at here today is the stock market is literally the biggest living breathing entity in the financial world. Meaning, outside of the Fed, there's no one person, group or basket of firms that can control these markets. Contrary to popular thinking, nobody outside of the FOMC can control what's going to happen in the stock market, which is why it's so vitally important that investors and traders only attempt to control what they can. Even then, the FOMC does not have total control over these markets.

Do the Fed and some of the biggest financial firms out there, like Goldman Sachs and JP Morgan, have a significant impact on the markets' behavior? Absolutely, but even they don't have total control. Sure, they can and do impact things day-to-day, but the one big disadvantage they have is it can take them days, and even weeks, to build or unwind positions. Whereas the biggest advantage individual traders/investors have is the ability to be nimble - getting in and out of something whenever they want without affecting its price action.

In a day and age where commissions for buying/selling anything is anywhere from minimal to free, investors and traders can be even more nimble than ever before. As a matter of fact, gone are the days investors/traders are left holding the bag, but that's only assuming they have enough of the right information and analysis to know what's actually going on. This is precisely why I spend just as much time in the newsletter here trying to educate investors and traders as we do giving them quality names/ETFs that should work well over time.

With that, I mentioned above the importance of only controlling what we can, which means what to buy, what to short, when to buy, when to short, and ultimately when to cut an idea, or take the profits. And right now, these markets are not offering extremely low risk high reward opportunities to the long side. Instead, just about everything out there continues to wiggle and waffle around with no clear direction.

The bottom line is it's always going to come down to the three most important things toward being a successful trader or investor - knowing one's strategy, understanding the probability associated with the idea in question, and ultimately managing the risk associated with the idea in question.

With that, and in an attempt to clean up or manage one's portfolio, here's some general rules one should assess toward determining what to do with something you own...

1) If you bought something anywhere prior to the fourth quarter of last year, and it hasn't performed by now, I'd get rid of it. If it hasn't performed by now, it's probably not going to perform. Sure, there are anomalies, but again it's all about probability.

2) If you bought something in the fourth quarter last year, or first quarter of this year, and it's a high quality proven name, there's nothing wrong with sticking with it because we do believe these markets will make new highs again.

3) When a high quality name or ETF gets too far away from its short-term moving averages to the upside on its daily chart, there's a very high probability it's going to come back to those same moving averages. Then and only then does the probability for higher levels increase dramatically.

4) This same notion becomes even more so when you use longer-term weekly and monthly charts. Meaning, when the idea in question gets way too far away from its long-term moving averages to the upside, the probability for a major selloff in that idea increases dramatically. Conversely, when something comes back to its longer-term weekly and monthly moving averages, the probability of a major reversal is about as good as it will ever get - assuming the idea in question is fundamentally proving itself.

5) When it comes to small stocks, technicals don't matter much, which is why you have to determine in advance of buying any small cap whether or not it's a trade or an investment. In other words, are you going to continue to stick with it no matter what, or are you going to create a plan, and ultimately trade that plan.

Why traders will continue to hang on to losers when trading something on a short-term basis is beyond me. Why investors will buy low quality names and hang on to them forever is also beyond me. At the end of the day, there's nothing wrong with taking a reasonable loss on anything, because at the end of the day it's always going to be about knowing one's strategy, assessing the probability, and then ultimately managing the risk.

There's always another day, and always another opportunity, so whatever you do don't let fear and greed manage your decisions. Instead, be 100% completely pragmatic and objective, and focus on the things you have control over. Hindsight is ALWAYS 20/20, so unless there's something one can learn from hindsight, there's literally no value in looking in the rear-view mirror.

Excerpts from 5/14/2021 Newsletter Edition: More On Why Stocks Do What They Do - Levels to Consider On QQQ, SPY, IWM, DIA, Ethereum and Bitcoin

Ever wondered why a stock just keeps screaming higher or lower with no real fundamental reason for doing so? Meaning, why would a great company's stock collapse for no apparent reason, or a terrible company's stock would keep screaming higher for no apparent reason? Ever wondered why your protective stop is taken out just before a stock or ETF turns around and goes higher? Ever wondered why a stock can get so hot only to become so not? How about a stock that completely disconnects from a very attractive fundamental landscape?

First, we say it all of the time... in the end fundamentals will always win, which is why long-term investors should only ever focus on what stocks are worth, and more importantly stick with only those companies that are fundamentally proving themselves over and over again. However, when it comes to short to mid-term trading anything, it really doesn't have half as much to do with the above as it does the inventory of the stock at the time one is trading it, and more importantly what desk traders and market makers are doing with that stock.

In other words, on behalf of their biggest clients, it's a desk trader or market maker's job to hunt for volume, shake out weak hands, get stock on the cheap, and ultimately sell that stock into strength. Look at it like this... you go to the farmers' market, and everyone is yelling and screaming for you to buy their produce. They're advertising it with shiny signs, and making their produce look as pretty as possible. Some are selling their produce on the cheap, but for good reason - their produce just isn't very good.

Some are more expensive than others, because their produce is simply that much better, while others are willing to sell theirs for virtually nothing because maybe it's smaller and just doesn't taste that good. On great days, the market is lively and full of customers, while other days, the crowds are small and demand just isn't all that high.

Meaning, when the crowds are big everyone is willing to outbid each other, but when the crowds are small the farmers are a bit nervous, and are willing to reduce the price of their produce for fear they can't get rid of it. There's even those time periods when the farmers' crops were light or overly abundant, as well as time periods when the customers are worried about having too much or too little food on the table. All of it has an effect on the supply, demand and prices for the produce in question.

So what does this all have to do with market makers and desk traders? On behalf of their biggest clients, they have the product. They do the advertising, they have the shiny signs, they know how much produce they have, and they're the ones that are going to figure out a way to sell as much produce as possible because that's how they make money - by generating volume. They're going to try and sell that volume for as much as they can until nobody is willing to pay those prices anymore, or until there is no produce left to sell.

With that image in mind, the above is why we'll never ever suggest penny stocks. The very large majority of any penny stock is typically controlled by only a few, or sometimes just one. Meaning, you are at the mercy of somebody who owns the majority of that stock. And because of that, they can price manipulate it, move it up or down at will, and even paint a beautiful chart - advertising their cheap produce at higher prices. Then, unknowing investors come piling into that stock, only because someone has made it look really shiny.

Then, there's everything from those promising small caps to the most darling mega caps that consist of some of the greatest companies on the planet. Even then, however, the game is somewhat the same. Desk traders and market makers are going to work that stock in a way that generates the most volume at the highest prices, get that same stock cheap again, and then depending on the technical/fundamental landscape, bring it back at higher prices, or let it fall into oblivion because it was clearly never worth anything close to what they sold it at.

However, when it comes to those promising small caps and darling mega caps, you have very savvy and intelligent customers who are only willing to pay a certain price anymore before they'll say it's just too expensive. You also have very large funds and institutions that are going to put their money to work in the right names for the long haul, never touching it for years and years, because they know the company they've invested in is going to do very good things in the years to come.

What I'm getting out here is desk traders and market makers are always looking for volume. However, we use a number of the same tools they do showing us where volume support is, where volume resistance is, and ultimately use our fundamental analysis in an effort to bring you profitable ideas year in and year out. Still, when desk traders and market makers can't find the volume, they'll take something as high or as low as they can until they either find buyers, sellers, support or resistance.

This is why you will see a stock run to the moon on air or fall into oblivion despite being a fundamentally great company etc.. In other words, it's ALL ABOUT PRICE AND VOLUME ACCEPTANCE. Meaning, when desk traders and market makers can no longer find volume at a certain level, they'll take it back the other way and vice versa - until a point in time they find price and volume acceptance at hopefully the highest possible price.

However, there are even other very obscure nuances that can impact even the greatest of companies' stocks. Case in point, when you have a stock, let's say Disney or Advanced Micro Devices, that big funds and institutions have large holdings in, desk traders and market makers know this. Meaning, they know the large majority of that stock isn't going to be sold.

This creates an opportunity for them to push the stock around all over the place, because there's actually not that much stock floating around for sale in the retail community day in and day out. The less stock that's out there with the least amount of price acceptance, the more they're going to push it around, and that's precisely what's been happening to these markets lately.

So how do you/we deal with all of it, and more importantly take advantage of all of it? For a day-trader or swing trader, it's very important to know where the price acceptance is, where it isn't, and knowing where the institutional support/resistance is. If you know this, you have an edge 99% of the retail trading/investing community does not.

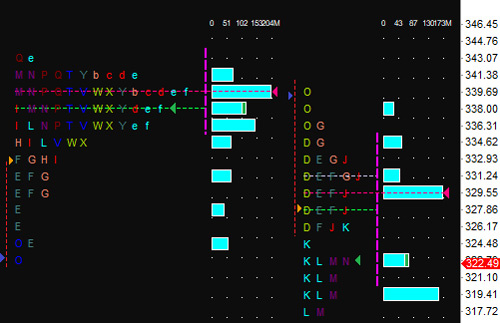

With that, I've provided images below of a few tools I use internally toward determining everything I just mentioned above. I'm not going to get into all of the details regarding how they're used today - just know this is a large part of my technical toolbox. First is a daily chart of QQQ, along with all of my preferred moving averages and volume at price. The latter shows you where the most volume is at a certain price. Are these the only technical indicators I use when charting? No, but these are some of the more important ones.

The second image below is a "Market Profile" for QQQ. This may look like Chinese to most, but this shows me particularly where the support/resistance for a stock really is - all the way down to the penny. Is it the end all be all for identifying what's going to happen with a stock? Absolutely not, but it is a tool that can give anyone a tremendous edge.

John Monroe - Senior Editor and Analyst