Want to Know What Our Recommendations Look Like? Here's an Example...

Published on September 10, 2021 @ 10:56am

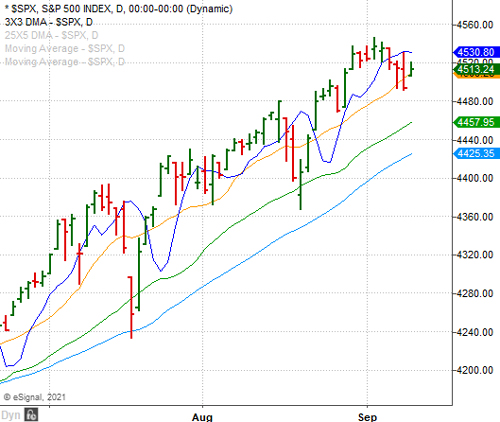

Adding Coursera, Inc. (COUR). Markets trip yet again to the downside. The S&P 500 and the DOW take out their Wednesday lows, while the NASDAQ and Russell 2000 manage to hold their lows for the time being. The beginning of something bigger? Maybe, so we'll keep a close eye on those same key moving averages that have managed to prove support for months.

New Investment Opportunity in Coursera, Inc. (COUR) - Major Indexes Remain Under Pressure

Enter Coursera, Inc. (COUR), one of the fastest growing online learning companies in its industry. With 250 high profile partners like Google, Amazon, ASU, Columbia University, Duke, Dartmouth and others, spanning 54 countries with 7,931 online courses, Coursera is very well positioned to offer long-term investors with homerun type returns over the next several years and beyond.

In short, the Company operates an online educational content platform that connects learners, educators, and institutions. It offers online courses that include data science, business, computer science, information technology, health, social sciences, logic, project management, and digital marketing services; campus student plans; degree courses; and certification education.

As you can see, Coursera is focusing its online educational efforts in those areas that are sure to be among the most attractive growth sectors of our economy over the next decade and beyond. Add that to a very troubled public educational system here in the US right now, and we do believe Coursera is well positioned to continue its growth trajectory.

With a current market cap of just under $5B, this pure mid-cap play has roughly $800M in cash on the books and only $23M in debt, so from a balance sheet perspective it's in good shape. Although it has yet to turn a profit, you can see the Company has plenty of cash on the books to see its way to profitability.

Equally as important, the Company has managed to substantially grow its top line revenue year after year. More recently, it managed to grow revenue by 38.50% over the comparable quarter a year ago, and that's compared to a time period when online learning was just starting to really take hold.

While only projected to grow its revenue another 23% next year, this does not account for any future pandemic issues, and it definitely doesn't account for the potential of the Company to continue to grab market share within what is projected to be a big shift in education here in the US over the next several years.

Considering the global e-learning market is projected to grow to $370B by 2026, from $226B in 2020, at a CAGR of 8.56% through 2026, Coursera is well positioned to not only continue its sector leadership, but continue to pave its way toward large cap status. Meaning, a double or triple in market cap size over the next few years would be no surprise.

The bigger issue right now is whether or not the stock has actually bottomed around recent levels, because the growth stock sector of these markets continues to be punished by the day. However, for those who've been with us for any significant length of time, you know it's always been my opinion that most IPOs will end up taking out their IPO lows at some point early in their public company life-cycle. COUR was no exception.

Provided here is a daily chart of COUR dating back to its April IPO. As you can see, the stock took out its IPO low back in May, and has continued to trade in a very volatile range ever since. Is the bottom in? That's likely to be predicated on whether or not the stock can hold its recent lows, and more importantly when the growth sector of these markets is going to pick it again.

Nevertheless, the buy-side volume in the stock has been attractive of late, and most of that can be attributed to some very large institutional participants. As of August, the Vanguard Group Inc. increased their ownership in COUR to a total of 4,582,908 shares, or an increase of 23,149.3%. BlackRock Inc. did the same to the tune of 932,074 shares, or an increase of 1,142.8%, while Baillie Gifford & Co. reported 8,689,875 shares owned for an increase of 164.2%.

Considering all of the above, we're going to go ahead and add COUR to our current open list today and suggest investors pick up a piece of the Company for the long haul. Just be prepared for some volatility in the event these markets continue lower for a bit. Regardless, we'll set a mid-term price target at $51 per share, and a longer-term price target at its all-time high of $62 per share. I'm convinced it will get there. The bigger issue is how, so be sure to assess your risk tolerance and go from there.

As for the near-term landscape for equities in general right now, these markets continue to remain under pressure for the time being. Provided here are daily charts of the NASDAQ Composite and S&P 500. As you can see, the S&P 500 breached its Wednesday low yesterday, while the NASDAQ did not.

The bottom line is we're still eyeing the strong technical possibility of the DOW Jones Industrial Average achieving our previously published downside target of 34,302. That would likely put the S&P 500 somewhere down around 4,450 to 4,420. Then, we'll just have to see what happens around those levels. However, if we get there in a straight line I would expect at least a big temporary rally off of those levels.

Current Stance for Equities:

Create a Free Trial Here To See Our Current Stance for Equities: https://www.vikingcrest.com/register

Suggested Long-Term ETF Holdings:

Create a Free Trial Here To See Which ETFs We Continue to Suggest Investors Maintain Exposure To: https://www.vikingcrest.com/register

Individual Company Ideas:

Create a Free Trial Here To See Which Stocks We've Recently Suggested: https://www.vikingcrest.com/register

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst