Client Newsletter Example: Important Price Support Levels for QQQ and SPY - Op--Ed On the Debt Ceiling, Deficit, Volatility, Media and Social Platforms

Published on October 6, 2021 @ 9:02am

An op-ed on the debt ceiling, the deficit, the markets' volatility, the media and all of the rhetoric regarding Facebook (FB) and other social platforms. More back and forth volatility continues to plague the very short-term outlook. Reiterating the possibility of another washout of recent lows before the S&P 500 should stage its biggest bounce in weeks. Here's the most important price support levels for short-term traders to eye on both the NASDAQ 100 tracking QQQ and the S&P 500 tracking SPY.

Important Price Support Levels for QQQ and SPY - Op--Ed On the Debt Ceiling, Deficit, Volatility, Media and Social Platforms

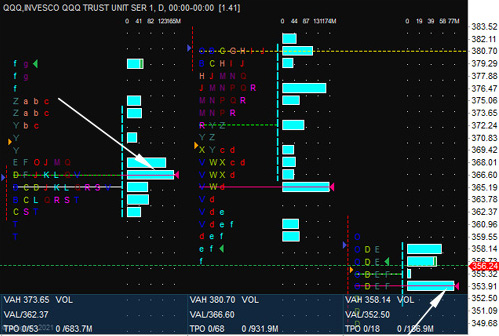

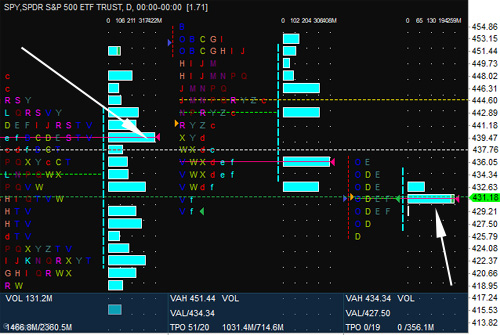

Before I get into what I consider to be a pretty important op-ed today on a few very important market related issues, we're getting more volatility across the Major Indexes today. Provided here are hourly charts of QQQ and SPY, two of the multi-year leading ETFs tracking the NASDAQ 100 and S&P 500. I've also provided some daily market profiles showing you the most important support/resistance levels are for these ETFs right now.

As you can see, the back and forth volatility has been nothing short of insane. However, these markets are trying to work themselves out. I mentioned yesterday SPY could go down to $425 before it could stage its biggest bounce in weeks. But much of that is going to do with whether or not certain support/resistance levels are breached.

You can see I've pointed to certain key price points on these market profiles below (high left and low right white arrows) showing those more important price support/resistance levels. Keep in mind, it's more about where they close than it is what they do intra-day. With that, QQQ needs to hold a daily close above $353, and more importantly break above $367 to add more context that a bottom is in. SPY needs to hold a daily close above $431, and more importantly break above $440 to add more context that a bottom is in.

The bottom line with respect to both ETFs is although none of the above is the end all be all for near-term analysis, those are the levels short-term traders may want to use toward determining whether or not they want to stay long, get long, stay short or get short any of the bullish or bearish leveraged index ETFs.

There's no question things continue to remain pretty dicey on a very short-term basis, so for those who continue to take the profits when they're there, you've got to be doing pretty well. As for the long-term buy and hold investor, we will want to take even more advantage of lower levels should we get them.

I want to take a few minutes today and provide my opinion on a few very important issues that continue to swirl in and around the media that are most certainly going to have an impact on these markets, as well as some of those darling tech names investors have become so accustomed to love.

First, I think we can all agree the media has literally become the single most fear mongering media in American history. Not to say the media hasn't always loved a little fear mongering, but in a day and age where there's so much transparency in the world, the media has made it their focus to exacerbate anything and everything in an effort to get viewership and ratings. At the same time, however, many Americans have also become pretty numb to whatever it is the media is sensationalizing at the time.

Right now, it's all about whether or not Congress is going to raise the debt ceiling, which comes at a time when many Americans are extremely concerned about the future of the US deficit. It's an underlying conundrum of sorts for the markets and investors, as one side says we can't afford a much larger deficit, while the other side says it's not a big deal until it becomes a big deal.

Honestly, it's all going to come down to economic growth. Why? Many of you might remember back in the late 90's the US deficit had gotten out of control yet again. However, President Clinton ran into an accident called the commercial Internet, which through the massive economic growth that was spurred by the Internet, the Clinton Administration was able to balance the deficit.

My point is that could happen again, because for those of us who spend all day every day following the economy, and more importantly those disruptive technologies that continue to change the world, the projected growth of everything from green energy to space, infrastructure, and the Internet of Things (IoT) could end up providing such massive economic growth that we look back 20 years from now and see the same result we saw 20 years ago.

Additionally, I don't think there's any chance whatsoever that the debt ceiling won't be raised. Sure, we could see a lot of drama regarding it. We could even see delays regarding it, which would likely trigger even more market-wide volatility than we've seen all year. However, when it's all said and done I do believe the debt ceiling will be raised, and these markets will look for something else to be concerned about. Remember though, Wall Street loves to climb a wall of worry.

So what has created all of the wild swings and historically high volatility in the market place these days? If I had to list them in order, I'd say the media, brokerage firm market makers, and then the deficit. Meaning, the media is literally using whatever they can from day-to-day to create an uncomfortable feeling for Americans, while brokerage firms are making their money via volatility now instead of trade commissions, all while many Americans have been led to believe our country's leadership in the world has been lost.

Honestly, it's the latter that I would argue with anyone, and it's got nothing to do with politics, because most of you here probably know by now I'm a very fiscally conservative individual, which brings me to my final point. One of the greatest technologies to be developed in the last 20 years is artificial intelligence (AI), and Facebook (FB) is arguably the leader in the field. It's also what makes the stock so attractive to me as a long-term investment.

Don't get me wrong, I am no social media fanatic. As a matter of fact, I'm the one individual in our household that's always complaining about it. However, when it comes to investing it's important we maintain a professional outlook, and not let our personal or political opinions get in the way. What I'm getting at here is with the witch hunt that's going on in Congress, it's far more important for everyone to know the truth. And the truth is Facebook's AI is working like a charm, yet everyone wants to blame them instead of themselves.

What I'm getting at here is if you're a devout Christian, you will be fed anything and everything on social media that has to do with Christianity. It doesn't matter what your religion is, if your faith is strong you will be fed everything about that religion. If you're a doom and gloom world coming to an end type person, you will be fed all of the doom and gloom conspiracy theories. If you're a hard left liberal, you will be fed such, and if you're a hardcore right conservative you will be fed such.

It even comes down to the littlest of things like your hobbies. If you like boats, you will be fed boats. If you like traveling you will be fed traveling ads and content. I'm sure you get the point. So, while every social platform from Facebook to Snap, Tik Tok, Twitter, Instagram and YouTube continue to come under social pressure, it's important to remember a few very important things.

First, it's the use of AI that's not only going to determine what you see on social media, it's literally what's making all of these companies so much money. I know, that may sound a little capitalistic, but quite honestly it's the way people perceive things that is going to determine their future - social media or no social media. In other words, companies are always going to look to provide people with what they want. The problem nowadays, however, is what people want isn't always what they should want.

The bottom line is we all have the gift of free will. Although things change, human nature will never change. So when it comes to those big tech companies like Facebook, Amazon, Alphabet, Apple, Netflix, Microsoft, Twitter, Snap and others, they're all going to lead the technology earnings until somebody better comes along. Therefore, I would not be bailing any of those companies based on whatever the media or the government is doing or saying. As a matter of opinion, the lower they go I'd be inclined to be a buyer of any of them.

Current Stance for Equities:

Create a Free Trial Here To See Our Current Stance for Equities: https://www.vikingcrest.com/register

Suggested Long-Term ETF Holdings:

Create a Free Trial Here To See Which ETFs We Continue to Suggest Investors Maintain Exposure To: https://www.vikingcrest.com/register

Individual Company Ideas:

Create a Free Trial Here To See Which Stocks We've Recently Suggested: https://www.vikingcrest.com/register

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst