Client Newsletter Example: A Rear View Look at 2021 and a Look Ahead Into 2022 - Happy New Year All!

Published on December 31, 2021 @ 6:42am

Here's a look at the year past and the year ahead. Lesson to take away from 2021, and lessons to apply in 2022. What didn't do as well in 2021 may well be what does well in 2022. However, it's still going to be many of those large/mega cap names that have done well in years past that continue to do well in 2022. Here's the details on all of it...

A Rear View Look at 2021 and a Look Ahead Into 2022 - Happy New Year All!

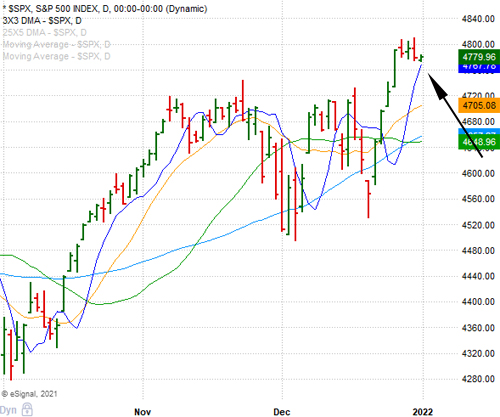

Before I get into the year in review and the year ahead, let's take a look at right now, and what we might expect as soon as next week. Provided here are daily charts of both the NASDAQ Composite and S&P 500, the two most important indexes to these markets over the last twenty years. As you can see, they're coming back to those key short-term moving averages I've pointed to all week.

Considering how bi-polar these markets can be from day-to-day and week-to-week, I suspect the moving averages I've pointed to here need to hold into early next week, or we could be looking at even more downside. However, despite any near-term weakness, the longer-term charts still point to higher levels ahead - especially if we end up with what has historically been referred to as the "January Effect''.

Simply put, the January Effect is the anomaly that can take place to start a new year of trading, whereby all of those higher quality fundamentally proven names that were beaten down in the year prior, and more importantly sold for tax loss purposes, come roaring back with buying in the new year. And, considering there have been thousands of names that have met this criteria in recent months, the January Effect may end up becoming a very real thing next month. We'll see. For now, there's still nothing to suggest a major market breakdown.

2021 was clearly an "all over the place" year. Volatility was abnormally high, but for those who stuck with extremely high quality names/ETFs, managed their trades and investments with disciplined stops, taking the profits when they were there etc., it turned out yet again to be another good year. However, the small/mid cap growth stock disaster that started to surface back in April clearly had its impact on just about everyone's returns.

Nevertheless, we did manage to come out of 2021 with yet another good year, as the first quarter more than made up for some of those small/midcap names we suggested since then that simply haven't performed yet. That's the nature of small and mid-cap stocks though - huge swings in both directions before the right ones end up becoming big winners.

Interestingly enough though, 2022 may well end up being a very good year for the small and mid-cap sectors of these markets. However, it may not happen until we finally end up getting a much bigger correction than anything we've seen since this whole COVID disaster started to surface almost two years ago. I'm sure we can all agree it would be a very welcomed event when the bulk of the COVID problem finally comes to an end. And when that happens, these markets may well return to a more normalized state.

The good news is there's an awful lot of chatter out there that Omicron may end up being a blessing in disguise. Considering it's a pretty mild flu strain and considering it's extremely contagious, there are a number of professionals out there that believe it may have spread enough of the necessary antibodies throughout the American population to finally bring it to an end - at least until the media or the powers that be decide it's going to be a problem again.

I chide, but we've all seen when COVID becomes a problem for these markets, and when it's no longer a problem for these markets. The problem usually surfaces when the Major Indexes are very overbought on a short-term basis, and then it's no longer a problem when the Major Indexes are extremely oversold on a short-term basis. Still, the majority of these markets have been in a bear market since April, so once everything starts to mend again we could end up seeing a melt-up on the Major Indexes.

For now though, it's going to most certainly continue to be all about risk management. Meaning, if your trading timelines are short-term in nature, don't get greedy. Take the profits when they're there, and make sure to use protective stops you're comfortable with. If your timelines are very long-term in nature, I still see no problem in holding high quality names and ETFs for the long haul, as we do believe these markets will end up much higher than they are now.

At what point will these markets start to develop a far more important top than anything we've seen since February of 2021? I'm still convinced that's not going to surface until we actually get a blow off top. Meaning, a big runaway move to the upside on all of the Major Indexes without any minor breathers along the way.

So what can we take away from 2021 into 2022? This year was another harsh reminder for the experienced trader/investor, and the single biggest lesson for the newbie, that stocks can and will go much higher and lower than anyone would have thought. It was another great reminder for traders/investors to not get sucked into whatever growth theme may seem hot at the time, as green energy stocks of all kinds got hammered for well over six months.

Always ask yourself, if you didn't buy it then why are you buying it now? In other words, it's perfectly OK to speculate on an early breakout or selectively bottom fish on that which makes technical and fundamental sense. But, never get caught up in the hype of something that continues to run with no real proven fundamental merit. 2021 was a perfect example that even the best most promising growth themes will always take time to play out, and it also proved that companies with no real fundamental merit cannot sustain even the hottest of runs.

Additionally, 2021 proved yet again nothing is ever going to be more important to the stock market than interest rates. Outside of some majorly negative geopolitical black swan type event, these markets will always fixate more on interest rates than anything else. We also learned that Fed Chair Jerome Powell is the single most important influencer to the entire financial system - not the president of any country, not any big brokerage firm, not the people, not anyone. He drives just about everything with the FOMC's monetary policy.

What can we expect heading into 2022? More of the same insane volatility that has continued to plague these markets for almost two years now, so patience will be key. However, we will work diligently to take strong advantage of extremes, as we can most certainly expect more nonsense from the financial media.

We can also expect more new all-time highs that could very well end up being led by sectors that didn't do all that well this year. Specifically, industrials, re-opening stocks, biotech (not pharma), transportation, small caps, and possibly even a resurgence in some of those previously promising growth themes. All of these sectors and growth themes may end up getting washed out at some point, but they could be among those sectors that do end up doing well next year.

Of course we still don't see most of your darling FAANG + TMs underperforming these markets in 2022, but traders/investors will likely have to remain patient before getting too aggressive with your very high quality tech names. Tech is the one sector that did get more expensive in 2021 than any year prior, so the multi-month carnage in many tech names may not quite be over yet. Meaning, even if we get a big run higher in these markets, tech may end up being the sector that eventually leads it lower.

Cryptos and Commodities? Commodities are going to be very tricky in 2022. We saw the big run in commodities coming late last year and into earlier this year well before it happened. However, it may well not be something traders and investors will want to toy with much until a point in time commodities end up getting washed out in a big way. Commodities are frustrating, so it's always better to play contrarian and take advantage of the extremes in either direction, because the Fed can squash a commodity trade in a New York Minute.

Ex oil, which will likely continue to do well, we may end up seeing this whole inflation thing take a breather before it could end up actually becoming a longer-term problem down the road. So for now, we're going to suggest everyone remain patient with commodities unless something far more dramatic surfaces to suggest otherwise.

As for cryptos, although we do believe there will be another big run in 2022 for bitcoin and ethereum, it's going to be far more about where they're going to end up bottoming first. The thousands of other smaller cryptos out there, however, will remain a big gamble. Still, if you want to gamble in small amounts on those that look technically attractive at any given time, it's definitely better than a slot machine, black jack table or betting on a sports game.

We want to wish all of you and your families the very best in 2022. We never take for granted your continued loyalty over the years. We know you have plenty of choices out there, so considering our client retention rate is among the highest in the industry is a true blessing.

While we continue to believe our clientele is among some of the brightest and sharpest minds out there, we will always strive to bring you more and more value, education and ultimately better returns - no matter what your strategy and timelines may be. We appreciate you, respect you and will always strive to bring you the most objective, accurate and honest research/analysis out there.

Enjoy your NYE! We'll see you all bright eyed and bushy tailed Monday morning.

Current Stance for Equities:

Create a Free Trial Here To See Our Current Stance for Equities: https://www.vikingcrest.com/register

Suggested Long-Term ETF Holdings:

Create a Free Trial Here To See Which ETFs We Continue to Suggest Investors Maintain Exposure To: https://www.vikingcrest.com/register

Individual Company Ideas:

Create a Free Trial Here To See Which Stocks We've Recently Suggested: https://www.vikingcrest.com/register

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst