Client Newsletter Example: Must Read - Major Indexes Pause Right On Cue - Here's What To Expect and Consider In the Days/Weeks Ahead

Published on March 8, 2022 @ 8:28am

Despite all of the ongoing volatility across the major indexes, they all ended up closing yesterday right around their most important support levels. Here's a very careful analysis of what to expect now, and where things could potentially go from here. However, it's important to remember these markets are likely to remain headline driven for quite some time - with whatever happens in Ukraine being the trump card for equities on a go-forward basis.

Must Read - Major Indexes Pause Right On Cue - Here's What To Expect and Consider In the Days/Weeks Ahead

It's clearly been a very volatile few weeks, but it can all pretty much be attributed to what continues to happen in Ukraine. Although that's not likely to change anytime soon. all of the major indexes yesterday did end up closing right around their most critical support levels. That's actually a good thing, as the technical landscape for just about everything out there is still worth strongly considering.

I say that because oftentimes when we have geopolitical issues plaguing these markets, fundamentals and technicals can be thrown right out the window. Still, once things do finally decide to settle it's usually the technical landscape that ends up telling us when markets are bottoming long before anything else.

With that, I want to be very careful with how I communicate today's analysis, because if I don't it's not going to do any of you any favors. First, I've continued to reference certain key technical levels on all of the major indexes, and the ETFs associated with them, that if achieved, would be the most attractive risk/reward opportunities to get more aggressively long these markets again.

Specifically, the retracement levels shown on these daily charts below of the NASDAQ Composite, S&P 500, DOW and Russell 2000 Small Cap Index. As you can see, we're right there now. Additionally, I've referenced certain key buy levels on the NASDAQ 100 tracking QQQ, S&P 500 tracking SPY, DOW tracking DIA and Russell 2000 tracking IWM - specifically $330 - $324 on QQQ, $422 - $416 on SPY, $331 - $329 on DIA and then $194 on IWM.

I think it goes without saying these markets have now achieved their most critical levels to date, because in the event any of the above can't hold right around the lower end of those above-mentioned downside targets, the next big move can literally be any kind. Meaning, we could end up down around the single most important moving average that has provided every bottom since 2010, or we could end up snapping back sharply at any point before then on any significantly positive news coming out of Ukraine.

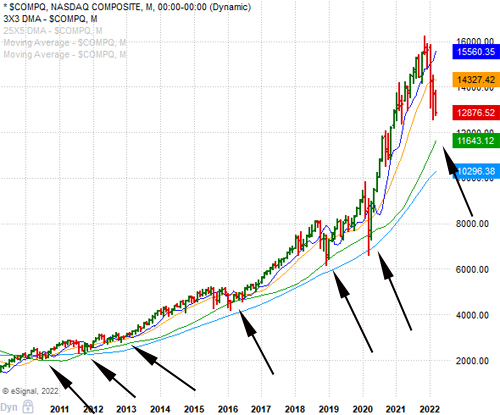

If nothing positive starts to develop between here and there, it's the 25X5 DMA (green curved line) on the NASDAQ Composite that has been the single most reliable trigger for the markets' bottom for over eleven years now. Meaning, every time these markets have staged their biggest corrections since 2010, it has been the 25X5 DMA that has held at the close of the month on six separate occasions.

Provided here is a monthly chart of NASDAQ Composite showing you what I'm referring to. As you can see, I've pointed to the six different occasions since 2010, whereby these markets have bottomed every single time. As a matter of fact, this is exactly what we used to determine where these markets would potentially bottom back in March of 2020.

So what's the problem? In the event things do start to escalate even more in Ukraine, that's about a 10% move from where the Composite is now and that 11,643 level I've pointed to above. That may not seem like much, but I can assure you if we do end up down around that 11,643 level, there's going to be an awful lot of additional carnage in not only names we continue to maintain exposure to here in the newsletter, but just about everything else out there as well.

To add to the complexity of the technical side of the equation, I would also strongly suggest investors/traders keep a close eye out for any significantly positive or negative news developments coming out of Ukraine that would likely end up triggering another big move in either direction for equities across the board. President Biden is expected to make some important announcements regarding Russia at 10:45 AM, which should include an energy ban on Russian imports into the US.

One literally can't make this stuff up. We've gone from what should have been a coming to the end of COVID, only to end up focusing on what's happening in Ukraine now. Although with God we're supposed to go from glory to glory, it sure seems like the world we live in now simply goes from disaster to disaster. However, if there's one thing we all know it's that things are going to change for the better.

It all just reminds me one of something one of the greatest investors of all-time, Warren Buffet, has said over and over again, "Buy when there's blood in the streets and never bet against America". The question remains though, has there been enough blood in the streets yet? Therefore, I strongly suggest every trader and investor check their gut, timelines, strategies and risk tolerance right now, because in the event these markets break those key support levels I mentioned above, the next big move could be any kind.

The bottom line is if you've been short-term swing trading with proper disciplines, or have continued to remain patient with your buying as an investor, you've probably been fine. However, if you're among the buy and hold investment community, you've likely been experiencing a fair degree of pain over the last few months.

However, we continue to believe if you're willing to step in and start adding high quality names and index ETFs anywhere between where these markets are now, and potentially where they may end up when it's all said and done, the current risk associated with these markets should be well worth it in the end. At least that's what history has taught us anyway.

Current Stance for Equities:

Create a Free Trial Here To See Our Current Stance for Equities: https://www.vikingcrest.com/register

Suggested Long-Term ETF Holdings:

Create a Free Trial Here To See Which ETFs We Continue to Suggest Investors Maintain Exposure To: https://www.vikingcrest.com/register

Individual Company Ideas:

Create a Free Trial Here To See Which Stocks We've Recently Suggested: https://www.vikingcrest.com/register

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst