Client Newsletter Example: Markets Vacillate Before the Biggest CPI Data Release All Year - A Look at Rates, the Dollar, Commodities and Metals

Published on July 12, 2022 @ 6:52am

One day before one of the most important CPI data releases, the major indexes are more than likely going to put themselves in perfect technical positions to keep traders and investors honest on both sides of the trade. Here's a look at where those levels will likely be, as well as a good look at interest rates, the dollar and why metals haven't started performing yet.

Markets Vacillate Before the Biggest CPI Data Release All Year - A Look at Rates, the Dollar, Commodities and Metals

Tomorrow morning, before the markets open, we're going to get what is arguably the single most important CPI data release all year. Not only is this release going to move the markets tomorrow, it has now become the single biggest driver of these markets on a go-forward basis. Why? It's now having a significant effect on everything from interest rates to the dollar, commodities and equities across the board.

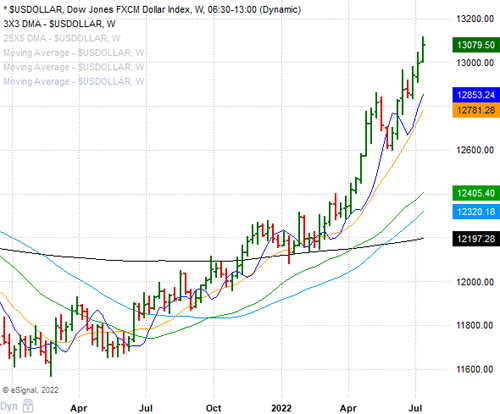

Provided here are weekly charts of the NYSE US Dollar Index, the S&P GSCI Enhanced Commodity Index, GLD and SLV, and the 30-Year Treasury Yield. First, you can see here the dollar has not only made new historical highs in recent months, it also appears to be in a final wave five expansion - one that "should" end up reversing the currency lower any week now.

Not only would that be good for stocks, it would start to suggest a much better economic climate for US exports, because when you consider most of the top S&P 500 companies derive much of their ongoing revenue from abroad, a lower dollar would be a welcomed event for those companies looking to expand their footprint in foreign markets.

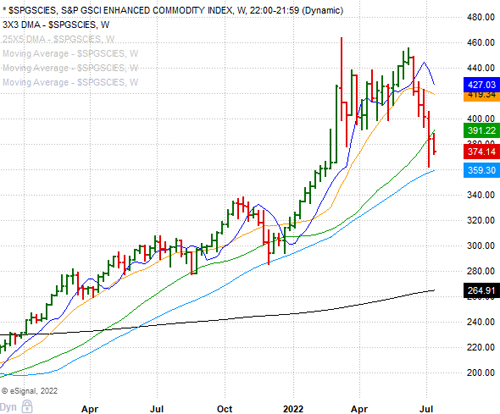

Although a lower dollar could potentially start to create a bit of a lift in the commodity world again, I can make the argument that one of the primary reasons for higher commodity prices in recent months has far more to do with the high dollar than it does excessive demand and lack of supply. As a matter of opinion, you can see here the S&P GSCI Enhanced Commodity Index back in March did appear to put in what is often referred to as a blow off top. Meaning, a top that will potentially not be seen again for a very long time.

Of course that's barring any more unexpected and unforeseen geopolitical events taking place like what has happened between Russia and Ukraine, but when you consider much of the supply constraint issues were mostly due in part to the pandemic here in the US, and then another pandemic lockdown in China just months ago, one has to consider the possibility that all of the recent mayhem in the commodity world could very well be coming to an end soon enough.

Metals, on the other hand, haven't done much at all lately, and most of that can also be attributed to the extremely high dollar. Why would anyone want the safe haven of metals when you can have the strongest currency in the world right now? Well, that too could be coming to an end soon - especially if the dollar finally starts to move lower again.

You can see on these weekly charts of GLD and SLV, the two primary ETFs tracking the price of gold and silver have literally been completely out of favor for months now. However, at the point the dollar actually does decide to reverse itself lower for much longer than just a few days, we should start to see a lift in metals again. That would be a very welcomed event for those gold bugs that have been screaming for a bullish metals environment for many months now.

But what's the biggest reason why tomorrow's CPI data release is going to be so important for the entire equity landscape? Interest rates. Literally nothing out there, no matter what anyone says, drives the equity markets more than interest rates, and it's the current rate environment right now that is making tomorrow's CPI data so important.

With that, you can see on this weekly chart of the 30-Year Treasury Yield that even though Fed Chair Jerome Powell raised rates last month, rates have actually moved lower ever since that day. This is something I pointed out weeks ago - when I mentioned one of the clues we'll be looking for when it comes toward determining when these markets could be bottoming, is to look for continuing lower rates even though the Fed has raised rates. Well, a few weeks does not make a new long-term trend, but what we're seeing with rates is encouraging.

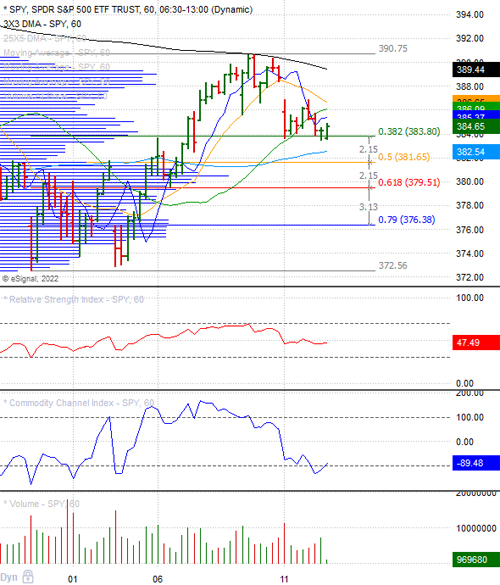

And finally, it's going to be no surprise whatsoever to see the major indexes literally put themselves right around some very important moving averages by day's end today. So much so that it keeps traders and investors on both sides of the trade about as honest as honest can get. In other words, these markets are likely to put themselves in perfect positions to keep traders on both sides guessing.

Provided here are those same hourly charts of QQQ and SPY dating back to their late June bottoms. As you can see, there are some very important short-term retracement levels and moving averages yet again that are going to either provide significant support, and a catalyst for much higher levels ahead, or they're going to end up being breached, which will more than likely send these markets lower at least one more time before they'll be in a position to stage their biggest rally so far this year.

Like I said yesterday, brace yourself, because if tomorrow's CPI data comes in hotter than last month (8.6%), these markets could very well end up moving sharply lower. However, should the data come in softer than last month, then these markets could potentially end up ripping higher - faster than anything we've seen all year.

Although we could very easily speculate on this particular either or scenario, I don't see much volume in it at this point. However, whatever happens tomorrow, you can be sure we're getting closer and closer to suggesting some high quality names and ETFs - on at least a short-term basis, and possibly even on a long-term basis. We're just going to have to see what that data release reveals, and go from there. Stay tuned.

Swing Trade Set-Ups w/ Suggested Trade Parameters

Create a Free Trial Here To See Our Current Stance for Equities: https://www.vikingcrest.com/register

Attractive Long Term Sector/Index ETFs and Individual Companies

Create a Free Trial Here To See Which ETFs We Continue to Suggest Investors Maintain Exposure To: https://www.vikingcrest.com/register

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst