Client Newsletter Example: Trading the Index ETFs On a Go-Forward Basis - Discipline and Profit Taking Will Be Key - "Ultimate" Bottom Still Isn't In Yet

Published on December 16, 2022 @ 6:52am

Must read edition for anyone serious about making money in this highly volatile market environment. All of the major indexes continued to unwind yesterday, but we can probably expect a pretty strong bounce starting as soon as today, or as late as Monday. Here's an op-ed and tutorial on how traders can play the leveraged index ETFs on a go-forward basis, but it's going to require some serious discipline, as well as taking the profits when they're there, because we're still not convinced the markets' ultimate bottom is in yet.

Trading the Index ETFs On a Go-Forward Basis - Discipline and Profit Taking Will Be Key - "Ultimate" Bottom Still Isn't In Yet

I've been saying it for months - we still expect these markets to move net lower when it's all said and done. While we did expect a much bigger move higher across all of the major indexes before the end of the year, I've continued to communicate here that we still believe these markets are going to end up making more new lows before the "ultimate" bottom is in. However, this does not mean disciplined traders can't take advantage of all of the big swings in both directions along the way.

Why am I saying this again today? Although all of the major indexes have once again unraveled in a pretty big way, they're actually now in a position to bounce sharply again. The problem, however, is that bounce may not end up being enough to take the NASDAQ 100 and S&P 500 above Wednesday's highs this year. It's possible, but it's going to require a lot of very quick damage repair to make that happen.

Therefore, by popular requests and demands, I'm going to share once again here how traders can take advantage of the all of the major whipsaws that continue to surface from week-to-week on all of the major indexes - all in an effort to capture gains on the leveraged or non-leveraged index ETFs without too much risk of holding anything in the event it doesn't work out.

In other words, if traders can be disciplined enough by using protective stops, and be willing to take the profits when they're there, they can still make money trading the leveraged or non-leveraged ETFs in both directions. I know most of you know this, but for those who are new to our newsletter here, I'm referring to TQQQ, SQQQ, and QQQ, as well as SPXL, SPXU and SPY.

While QQQ and SPY are the non-leveraged ETFs tracking the NASDAQ 100 and S&P 500 respectively, TQQQ, SQQQ, SPXL and SPXU are the leveraged ETFs tracking the non-leveraged QQQ and SPY - both up and down. Meaning, if QQQ goes up 1%, TQQQ goes up 3%. If QQQ goes down 1%, SQQQ goes up 3%. As for SPXL and SPXU, if SPY goes up 1%, SPXL goes up 3%. If SPY goes down 1%, SPXU goes up 3%.

Again, I know most of you know this, but I'm bringing all of this up again today because when it comes to our current open swing trading ideas, those type of trades are typically designed to last for more than just a couple of days, while our long-term ideas are designed to be just that - buy and hold ideas for the long haul. However, with these markets moving so freakin' fast now, traders can make money in a single day or two or three without too much risk.

As a matter of fact, ever since I've taught this strategy, we have a lot of clients/subscribers that have managed to do very well with it, but again it requires a consistent commitment to time/attention, patience, and most of all the discipline that it takes to flip things for some quick profits in either direction. And part of the reason I'm sharing this will all of you today is these markets continue to remain more volatile than anything I've ever seen, so a lot can change from the time you get the newsletter here to the time you get it the following day.

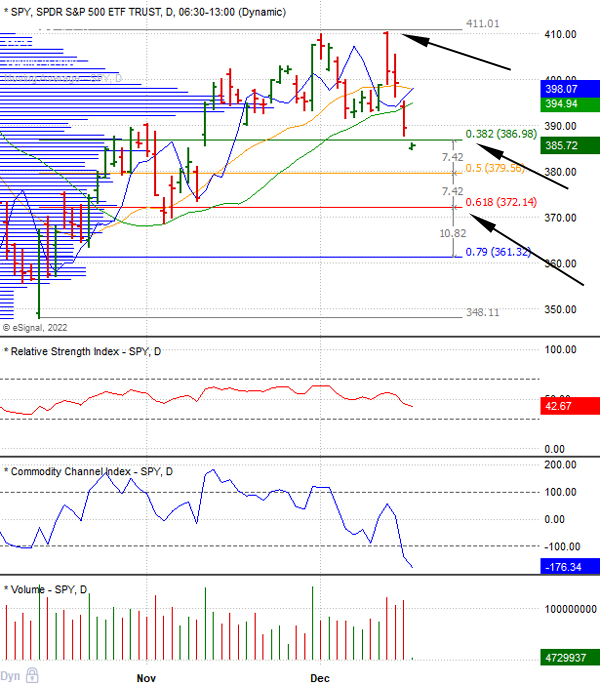

With that, I've provided those same daily charts of QQQ and SPY here (updated of course), along with our favorite tools: 3X3 DMA (dark blue curved line), 25X5 DMA (green curved line), 20-Day SMA (orange curved line), Volume at Price (horizontal blue lines to the left), RSI (Relative Strength Index), CCI (Commodity Channel Index), and then of course those all-important Fibonacci Retracement Levels, which works to identify when something can turn itself around for a quick trade back in the other direction, or a fairly major reversal level.

Now, while we did cut TQQQ and SPXL yesterday for obvious reasons that did end up saving everyone money by EOD, both of these leveraged ETFs are in a position once again to potentially bounce today, or as late as Monday. Like I said above though, even with a big bounce, I'm not 100% convinced now that QQQ and SPY are going to end up back above the Wednesday high that I've pointed to here without potentially making new lows first. It's possible, but the last few days have dramatically reduced the context for that.

Still, any potential bounce could end up being a big enough bounce for traders to make some money on TQQQ and/or SPXL. Then, once that money has been potentially made, we may end up simply reversing those positions back into the bearish leveraged ETFs in SQQQ and SPXU. Of course we'll be right here to point out any potential reversal levels between now and then.

And finally, always make sure to check the option contracts volume for the day vs. open interest (O/I) on TQQQ, SQQQ, QQQ and SPY. Those are the four most liquid index options out there, and they can most certainly be a big tell when the volume for a specific contract that expires the third Friday of every month is much higher than the open interest for that same contract.

Just remember, those big funds/firms opening big volume contracts are often a little early by a day or two. Meaning, the index ETF in question doesn't always cooperate quickly. Sometimes it takes a day or two for things to play out, but the percentage of being right is very high when you follow the volume on the index ETF options.

Therefore, and with all of the above being said, traders can pick up TQQQ anywhere around $273 on QQQ, but you're going to have to use a protective stop just behind that $273 level on QQQ. Meaning, if QQQ breaks too much below $273, it's likely going to end up down around $267, of which traders can take a shot on TQQQ there again. As for SPXL, traders can pick that up anywhere around $386 on SPY with a protective stop behind $386, because if SPY breaks too much below $386, then $372 comes into play.

As you've all seen this week, the markets' whipsaws are bigger and sharper than they've ever been. However, that makes for great trading if one is simply willing to take the profits after the big moves up or down. We clearly should have done that on Wednesday's open, but we gave these markets the benefit of the doubt that they could break above their top trend lines on their weekly charts, and that just didn't happen. Instead, market makers want to continue to move these markets sharply in both directions before the "ultimate" bottom is in.

As for the "ultimate" bottom, I still don't see that potentially happening until the first half of next year. The S&P 500 and NASDAQ 100 companies, as a basket, are going to have to deal with a potential earnings draw down, which is likely to become the next big concern for these markets. In other words, even with inflation finally starting to come down, the attention will continue to be on interest rates, as well as slower earnings across the board. The good news is that when these markets finally do bottom, the returns are going to be tremendous.

The bottom line is no matter what these markets do in the interim, we're going to be right here putting our best technical and fundamental feet forward to help all of you navigate what's to come. Believe it or not, there's plenty of money to be made trading the index ETFs in both directions, you're just going to have to have an awful lot of discipline, and be willing to assess your risk tolerance as to when you should take the gains.

Nevertheless, we'll continue to help you do that here until a point in time when the major markets have bottomed for good. Meaning, there is going to be a point in time these markets will end up putting in a bottom that's going to last years. We're just going to have to remain very vigilant until they finally do.

Swing Trade Set-Ups w/ Suggested Trade Parameters

Create a Free Trial Here To See Our Current Stance for Equities: https://www.vikingcrest.com/register

Attractive Long Term Sector/Index ETFs and Individual Companies

Create a Free Trial Here To See Which ETFs We Continue to Suggest Investors Maintain Exposure To: https://www.vikingcrest.com/register

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst