Client Newsletter Example: Profit Taking/Removing FRSH, PATH, LYV, CRNC and FOUR - Indexes Achieve Targets - META and PENN Miss and Beat - Big Tech On Deck

Published on February 2, 2023 @ 7:32am

META and PENN both miss bottom line estimates on better than expected revenue. Next on deck is AAPL, AMZN and GOOGL. The Fed delivers a modest increase to the Fed Funds Rate, while signaling inflation is coming down. However, now that all of the major indexes have achieved our very short-term targets, we're going to manage risk and lighten the load in anticipation of another market-wide pull back soon. Suggested profit taking and removing FRSH, PATH, LYV, CRNC and FOUR for now.

Profit Taking/Removing FRSH, PATH, LYV, CRNC and FOUR - Indexes Achieve Targets - META and PENN Miss and Beat - Big Tech On Deck

Plenty to cover today after the Fed raised the Fed Funds Rate another 25 basis points yesterday. Not only did just about every high quality name rip higher on the day, all of the major indexes achieved our very near-term targets just like that. Before I get into some moves we're going to suggest today though, as well as what's likely next for all of the major indexes, I want to bring up something that many have been asking.

Despite continuing to reiterate the fact that markets front-run what's to come, many have been asking when the Fed will stop raising interest rates, so rates can start to come down, and more importantly the equity markets can start to mend. Well, they already have.

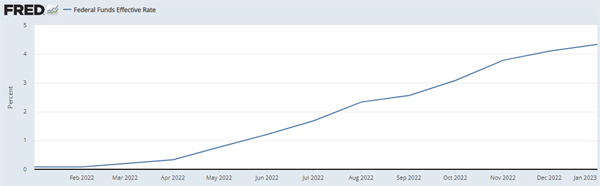

To paint the picture, provided below is a chart of the Fed Funds Rate dating back to January of last year. Also provided below is a weekly of the 30-Year Treasury Yield. See how the 30-Year Yield topped out back in late October? That's when the major indexes put in a bottom - one that has lasted up to now.

Again, the equity markets are forward looking not backward looking, so it's important to understand that even though the Fed has and will continue to raise the Fed Funds Rate, Treasury Yields may very well have already seen their highs for quite some time. Meaning, rates are likely to continue lower even though the Fed will continue to raise the Fed Funds Rate until a point in time he's got inflation under control, which he did allude to yesterday. And, the markets loved it - for now anyway.

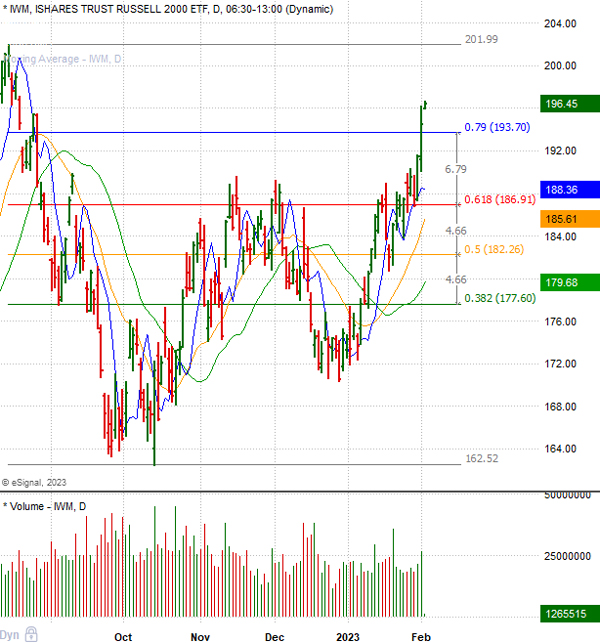

Provided here are daily charts once again of QQQ, SPY and IWM, the three primary ETFs tracking the NASDAQ 100, S&P 500 and Russell 2000 Respectively. As you can see, all three pretty much closed right smack on all of the targets we set for them just three days ago. That's a big move in just three days - so much so that we've decided to go ahead and suggest some profit taking in a number of our previously suggested ideas.

Specifically, we're going to go ahead and remove two of our previously suggested long-term ideas in FRSH and PATH for gains of roughly 10% and 40%. We're also going to remove and suggest profit taking in three of our previously suggested short-term swing trading ideas in LYV, CRNC and FOUR.

Additionally, if you're long any of the bullish leveraged ETFs tracking those above-mentioned non-leveraged ETFs, it's probably time to take the profits. Or, at the very least move your protective stops way up in an effort to protect the gains, while giving them some wiggle room to potentially move even higher. I'm referring to TQQQ, SPXL and/or TNA.

Let me be clear though, this does not mean we believe the recent bullish trend on all of the major indexes has come to an end. We do believe, however, they are in a position to pull back any day now. Considering many of the technical tools we like to use, these markets do appear to have achieved pretty overbought conditions on a very short-term basis. Meaning, we do expect a pullback soon, but we also do expect a potential resumption of the ongoing bullish trend that started back in October.

Whether or not the ultimate bottom is in still remains to be seen, but considering how oversold everything got on a long-term basis late last year, this ongoing bear market rally may still have legs when it's all said and done. Therefore, we're going to take a breather, and look to enter into some new ideas soon, or potentially even reenter some of those ideas we're backing out of today. All we're doing right now is our best to help everyone manage risk in what will continue to be a pretty hyper-volatile market environment.

Yesterday after the close and this morning before the open, META and PENN both provided their fourth quarter results. META missed bottom line estimates badly on better than expected revenue, while PENN did the same. However, META is up big, while PENN is down some.

While I won't get into the specifics of their numbers (pretty meaningless at this point), just know we still like both on a long-term basis. I will say, however, what's happening with META this morning looks a lot more like a short squeeze than it does big funds and institutions piling into the stock. Nevertheless, we'll take it, and stick with both META and PENN for the time being.

Finally, we've got three of the biggest companies on the planet set to report their quarterly numbers today after the close, but it's going to be far more about their forward guidance than it will be anything else. AAPL is expected to report earnings of $1.95 per share on revenue of $121.65B. AMZN is expected to report earnings of $.17 cents per share on revenue of $145.78B. And GOOGL is expected to report earnings of $1.19 per share on revenue of $76.48B.

For what it's worth in this ongoing crazy market landscape lately, AAPL's expectations would only be a modest increase on a comparable quarterly basis, and is projected to only grow its bottom line this year by a mere half of a percent, while only expected to grow its bottom line next year by a mere 9%.

AMZN, on the other hand, is expected to grow its bottom line this year by a whopping 1,433%, so it goes without saying we like AMZN a heck of a lot more right now than we do AAPL - no matter what they do today after the close, because as everyone should know by now, one or two days does not make a trend.

While we do like GOOGL more than AAPL as well right now, the Company is expected to report another comparable quarterly decline post close today. However, it is expected to grow its bottom line this year by about 9%, so you can see why we like GOOGL better than AAPL right now.

The bottom line is although these markets have clearly had one of the best January's on record, it does not mean they're simply going to continue higher and higher without any sort of breathers along the way. And that's precisely why we've decided to back out of some names for the time being.

Right or wrong, it's still all about trade and risk management, because we all know just how quickly things can change. Nevertheless, we'll continue to stick with the remainder of our previously suggested long-term ideas, as well as a few of our recently suggested swing trading ideas in CRWD and TWST.

Swing Trade Set-Ups w/ Suggested Trade Parameters

Create a Free Trial Here To See Our Current Open Short-Term Trading Ideas: https://www.vikingcrest.com/register

Attractive Long Term Sector/Index ETFs and Individual Companies

Create a Free Trial Here To See Which ETFs We Suggest Investors Maintain Long-Term Exposure To: https://www.vikingcrest.com/register

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst