Client Newsletter Example: Trading/Investing Lessons Shared - Fed Speak Didn't Matter - Pull Back Still Looms

Published on August 28, 2020 @ 10:41am

Trading and investing rules and lessons shared. Post Fed trading suggests it was a buy the rumor sell the news type scenario, as all of the major indexes and the VIX still suggest a looming reversal. Here's a few very speculative ways to potentially capture some gains in the event these markets do start to move lower, and where to potentially take profits in the event these leveraged ETFs start to work.

Trading/Investing Lessons and Rules Shared - The Pros and Cons to Leveraged ETFs

Before I get into the meat of today's newsletter, I want to reiterate a number of things I've said many times before. First, leveraged ETFs are not designed to be held for an extended period of time unless the leveraged ETF in question is working very well in your favor. Even then, they're far better designed for taking profits when they're there, and cutting them if they start to go the wrong way on you.

Why? Far different than non-leveraged ETFs like QQQ and SPY, which are designed for buy and hold investors to be held on a long-term basis, leveraged ETFs are designed for the short-term trader. Much like options, leveraged ETFs erode with time. So if a trader does decide to buy a bullish or bearish leveraged ETF it's important he/she maintains a discipline of using protective stops in the event the leveraged ETF in question starts to go the wrong way.

How much of a protective stop? That's up to you, but about 3% to 5% for me is plenty, but keep in mind that's only for a leveraged ETF, because when it comes to short-term trading an individual company idea I'm far more willing to give that idea a little more wiggle room - anywhere from 5% to sometimes even 15%. Why? Because typically individual names move a lot more in both directions than an index or sector based leveraged ETF will - especially when it comes to a small cap name.

I know most of you already know this, but every once in a while I'll here about someone who held a leveraged ETF in the wrong direction for far too long - not knowing the above. To be fair, I've also heard of those who were deeply underwater in a leveraged ETF, but still held it for a very long time and ended up making a killing on it. However, that type of strategy dramatically reduces one's probability for success. Therefore, I'd strongly suggest if one does decide to buy a leveraged ETF, he or she adheres to the above and below.

Leveraged ETFs are not for the faint of heart, or for those who don't have the time to pay attention. They move very quickly, and although the gains can be tremendous so can be the losses. Meaning, if the underlying non-leveraged instrument goes up or down 1%, the leveraged ETF instrument tracking it will go up or down 2% or even 3% - depending on how it's structured.

Now considering over half of our entire clientele base is of the more long-term buy and hold mentality, I want to point out protective stops aren't half as important as making sure you're investing in very high quality names and ETFs. Meaning, the most successful long-term investor will stay the course in a name for as long as it takes to realize the type of gains that can change lives over time - assuming of course nothing fundamentally disastrous has changed for the Company in question.

As a matter of fact, most successful long-term investors will even average down in a high quality name when the name or the markets in general fall off a cliff. However, one mistake many not so successful long-term buy and hold investors will make is averaging down in a name way too soon - leaving no dry powder left for when things get really ugly.

So when's a good time to average down in a very high quality name or ETF? As a rule, nothing less than about 20% in a high quality company. In other words, only until the high quality name in question has moved 20% or lower from where you may have bought it would it finally be a good time to consider averaging down in that idea. For a very high quality ETF, anywhere between about 5% to a 10% move lower isn't a bad time to buy in or average down - depending on the current market climate of course.

The bottom line with respect to all of the above is short-term swing trading requires tremendous discipline. It can be very profitable, but one can't be stubborn or take their eye off the ball. Nobody, and I mean nobody, which includes Warren Buffet or even the most successful fund managers on the planet, has a perfect crystal ball when it comes to anything on a short to mid-term basis. And this is why it's so important short-term swing traders adhere to an extremely disciplined set of his or her rules.

Conversely, one who's playing the long game must have a lot of intestinal fortitude and patience to stay the course, not get afraid, and more importantly be willing to step into (or average down) in those very high quality names and ETFs after everyone else has thrown in the towel.

Lastly, I've always said no matter who you are, and no matter what your strategy might be, it's very important to decide in advance of buying anything if you're going to trade it on a short-term basis or buy it for the long haul and hold it. Hindsight is always 20/20. Although you'll never go broke taking profits, most traders out there will never get rich flipping stocks back and forth either. It's just the way the markets work, so it's far more important to control the things you can, rather than let the idea in question control you or your emotions.

With that, although we've put out some great individual company trades and even better long-term investment ideas out there since the March bottom, we have attempted to short the major indexes on more than a few occasions since. Although we have made money at times shorting the major indexes on a very short-term basis via the bearish leveraged ETFs, we haven't been hurt all that bad when we were wrong.

Why? Protective stops. It's that simple. It's a very big misnomer to think the best traders on the planet are always right. As a matter of fact, many would be surprised to know they're wrong far more often than one might think. However, their success comes from their ability to manage risk by focusing strongly on positioning, and then managing the trade accordingly. I can't emphasize this enough.

Again, I know most of you already know all of the above, but we do have new clients and subscribers coming on board all the time, and lately many of them have been coming from the younger demographic. Therefore, I'm always going to feel obligated to do my best to teach those who might be new to the markets how to fish, instead of simply just giving them the fish.

Fed Speak Didn't Matter - Capturing Gains in the Event the Markets are Ready to Move Lower Now

Are these markets finally ready to take a breather? It goes without saying we're far closer to that notion now than at any point over the last five months. If you read yesterday's edition, then you already know I thought there was a big possibility yesterday's Fed announcement could be met with selling after some initial euphoria wore off. That ended up being the case for all of the major indexes after the first few hours of trading yesterday, which included metals. However, they're fighting back on the day yet again this morning.

Further, you can see here on this daily chart of the VIX Volatility Index traders and investors were piling into the VIX ETFs (like VXX) throughout the day yesterday in an effort to either capture some quick gains, or at the very least protect longer-term portfolios against any potential market-wide downturn. The VIX is a professional instrument used by many to eye a looming increase in market-wide volatility - specifically on the S&P 500. However, it's important to know those VIX ETFs in VXX and others move very fast in both directions.

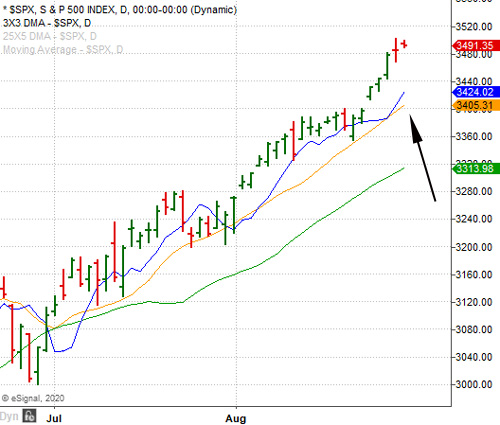

I've already pointed to the fact in recent days these markets have gotten pretty far away from some very important moving averages on both a short and mid-term basis. Provided here are daily charts of both the NASDAQ Composite and the S&P 500. As you can see, they waffled toward the close yesterday, but they're fighting back on the morning so far. You can also see they've gotten pretty far away from all of their short-term moving averages (colored curved lines).

Should they start to move lower as soon as today or as late as Monday, we're likely looking at a very near-term move back to those key moving averages I've pointed to here. For what it's worth, we did finally start shorting the major indexes again around yesterday morning's highs via SQQQ and SPXU - the two primary triple leveraged bearish ETFs tracking the NASDAQ 100 and the S&P 500 respectively.

Whether or not we'll end up being right remains to be seen, but I liked the positioning, and more importantly the risk/reward. And, just like I mentioned in the trading/investing lessons section above we do have protective stops in place to the tune of about 5% on both SQQQ and SPXU.

For those who don't have much bullish exposure to these markets right now, don't have the time to keep an eye on something like this, or aren't interested in tolerating the risk associated with a bearish index trade like the one mentioned above, there's no reason to participate. You don't have to trade every single idea we put out there.

Rather, address your own personal strategy, risk tolerance and overall exposure to these markets and go from there, because short-term trading anything isn't and never will be for everyone. Be rest assured though I'll continue to point out what I believe to be high quality names for long-term investment consideration when we think the time is right - per usual.

I simply don't like the risk right now associated with most names out there. Most have gotten very expensive, and although I 100% believe this long-term bull market is nowhere near coming to an end, it's far more about what the major indexes are going to do over the next few months. The markets have gotten pretty hot in recent months, so we'll continue once again to exercise a bit of caution around current market levels.

Again, my apologies if any of the above is a little too elementary today, but I do find it important to help educate those who might be newer to these markets or have taken a bigger interest of late. We'll return to your savvier and saltier channel on Monday. Until then, have a fantastic weekend.

Current Stance for Equities:

Create a Free Trial Here To See Our Current Stance for Equities: https://www.vikingcrest.com/register

Suggested Long-Term ETF Holdings:

Create a Free Trial Here To See Which ETFs We Continue to Suggest Investors Maintain Exposure To: https://www.vikingcrest.com/register

Individual Company Ideas:

Create a Free Trial Here To See Which Stocks We've Recently Suggested: https://www.vikingcrest.com/register

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst